Posted by Darragh Byrne, Marc Petitier, and Guy Potel, White & Case LLP, on Saturday, August 21, 2021

Editor’s Note: Darragh Byrne, Marc Petitier, and Guy Potel are partners at White & Case LLP. This post is based on their White & Case memorandum. Related research from the Program on Corporate Governance includes Are M&A Contract Clauses Value Relevant to Target and Bidder Shareholders? by John C. Coates, Darius Palia, and Ge Wu (discussed on the Forum here); and The New Look of Deal Protection by Fernan Restrepo and Guhan Subramanian (discussed on the Forum here).

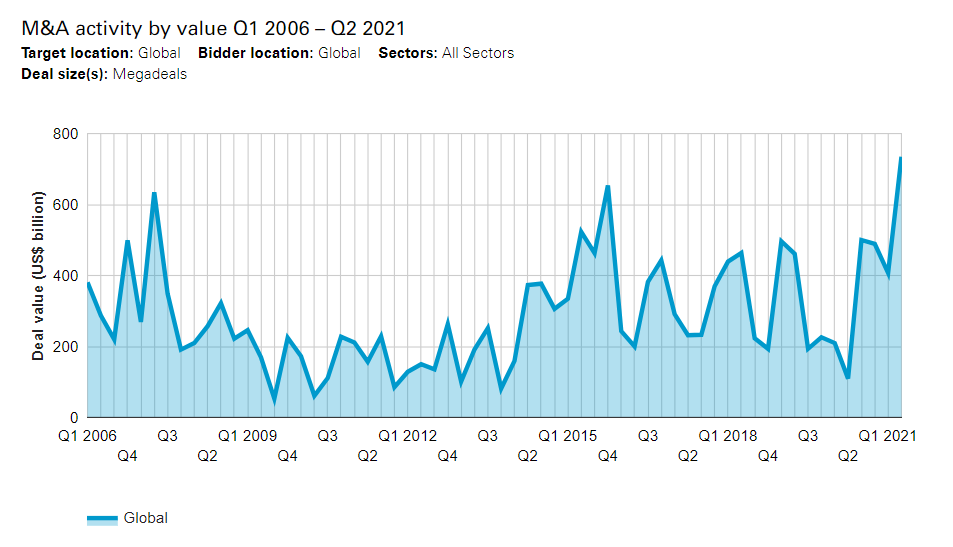

The second quarter of 2021 saw the announcement of megadeals (deals worth US$5 billion or more) totaling US$734.4 billion in value—more than in any other quarter on Mergermarket record (since 2006). Megadeal volume hit 45, the third-highest number in any quarter on record.

Activity at the top end was dominated by the US, with 25 megadeal transactions worth US$358.6 billion in Q2 targeting US-based companies. The largest of these was Discovery Inc.’s acquisition of Warner Media for US$96.2 billion, a ride on the bandwagon where traditional media players like Discovery and Warner seek to build scale—and a robust back catalog—to take on streaming mainstays like Netflix and Amazon Prime.