Gen Cap Exits Aero Systems

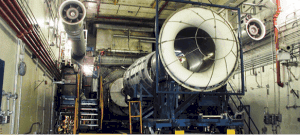

After just over a five-year hold, Gen Cap America has sold Aero Systems Engineering to Calspan Technology. Aero Systems Engineering (ASE) designs, builds and upgrades jet engine testing and wind tunnel facilities, and provides lab