![]() According to Datasite, over the next five years new technologies, including artificial intelligence, will transform the mergers and acquisitions process by decreasing the time it takes to perform due diligence to less than a month from three to six months today.

According to Datasite, over the next five years new technologies, including artificial intelligence, will transform the mergers and acquisitions process by decreasing the time it takes to perform due diligence to less than a month from three to six months today.

Datasite’s new report – The New State of M&A – is based on a survey of over 2,200 mergers and acquisitions professionals from corporations, private equity firms, investment banks, and law firms.

Due diligence is a prime area for digital transformation and is expected to benefit most from technology advancements, according to 48% of the respondents. Also, more than half of respondents (56%) also predict that by 2025, due diligence will take, on average, less than one month to complete. This compares to today, where dealmakers in the Americas, Europe, Middle East, and Africa (63%) report it can take one to three months to complete a deal, and between three to six months in Asia Pacific (66%).

“New technologies, such as artificial intelligence and machine learning, are making the entire M&A process, not just due diligence, faster and less labor-intensive,” said Rusty Wiley, chief executive officer of Datasite. “These new capabilities are valuable in managing all corporate actions, including restructurings, which are increasingly taking place due to the market downturn brought on by COVID-19.”

“New technologies, such as artificial intelligence and machine learning, are making the entire M&A process, not just due diligence, faster and less labor-intensive,” said Rusty Wiley, chief executive officer of Datasite. “These new capabilities are valuable in managing all corporate actions, including restructurings, which are increasingly taking place due to the market downturn brought on by COVID-19.”

Still, according to Datasite, there is some way to go before the M&A industry can be considered digitally transformed, as investment constraints and issues surrounding data security and privacy are still seen as large barriers to getting deals done.

For example, dealmakers noted that technology could accelerate the due diligence process and 35% said accessible virtual data rooms with artificial intelligence and machine learning technologies would help accelerate due diligence the most. However, a target company’s ability to provide ESG (environmental, social and governance) credentials or comply with data privacy regulations will increasingly affect whether a deal succeeds. A meaningful 78% of dealmakers said they had worked on deals where concerns about a target company’s ESG credentials prevented a deal from progressing, while 40% cited concerns about data privacy as having a similar effect on a deal.

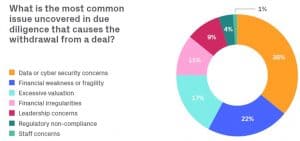

Thirty-six percent of practitioners said data or cybersecurity concerns represent the most common issue uncovered in due diligence that leads to withdrawal from a deal. Additionally, more than two-thirds of dealmakers (69%) said ESG factors and data privacy regulations will be important considerations in M&A due diligence by 2025, both up from the mid-teens today.

“The economic downturn has upended many organizations’ standard operating procedures, but the impact ESG concerns are having on M&A can’t be understated,” said Mr. Wiley. “The COVID-19 pandemic has called attention to how companies treat their employees, customers and suppliers, and ESG factors will likely continue to influence how companies select potential targets and business partners.”

Technology is not expected to solve all M&A process challenges. Most dealmakers say there are areas that simply cannot be automated through technology, especially when it comes to strategy (89%); negotiation (80%); and deal preparation (65%).

Other key findings from the report include:

- 31% of practitioners say incomplete or inaccurate deal documents and information is the most significant factor to slow due diligence;

- 65% of practitioners believe new technologies should enable greater analytical capability in the due diligence process in five years’ time; and

- 30% of practitioners believe technology will help improve and secure end-to-end processes, data management and communications the most.

Datasite (formerly Merrill Corporation) is a SaaS provider of tools and services used in mergers and acquisitions. The company was founded in 1968 and is headquartered in Minneapolis.

Datasite’s survey was conducted by Thought Leadership Consulting between February and April 2020.

To download a PDF copy of The New State of M&A click HERE.

Private Equity Professional | July 1, 2020

The post Datasite: AI to Speed Up M&A appeared first on Private Equity Professional.