Belmar Pharmacy, a compounding pharmacy and a portfolio company of Webster Equity Partners and MedEquity Capital, has acquired APS Pharmacy.

Belmar Pharmacy, a compounding pharmacy and a portfolio company of Webster Equity Partners and MedEquity Capital, has acquired APS Pharmacy.

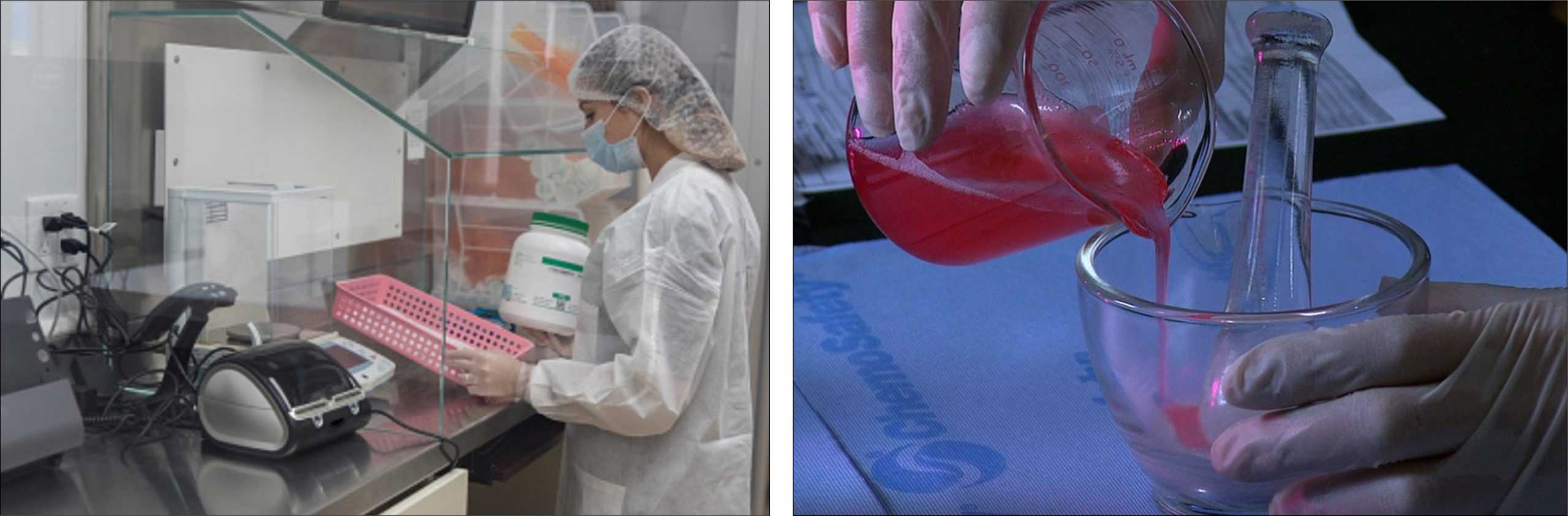

Compounding pharmacies combine, mix, or alter one or more ingredients to create a medication that is tailored to the needs of an individual patient.

Belmar, acquired by Webster and MedEquity in May 2019, services more than 6,500 providers and more than 64,000 patients annually across 46 states. The company, led by CEO Dave Hill, was founded in 1985 and is headquartered in Golden, Colorado.

Belmar operates both 503A and 503B compounding facilities. 503A facilities are traditional compounding pharmacies that produce a product in accordance with patient-specific prescriptions and are required by the state boards of pharmacy to comply with the USP (United States Pharmacopeia) and its guidelines. On the other hand, 503B facilities produce large batches of products, with or without prescriptions, that are sold to healthcare facilities.

APS Pharmacy provides pharmaceutical compounding to patients and physicians nationwide across 48 states. The company focuses primarily on hormone replacement therapy (injectable testosterone); as well as compounds for autism, opioid addiction, intravenous nutritionals, nootropics (substances that enhance mental skills); allergies; and erectile dysfunction. APS, a 503A pharmacy, was founded in 2005 and is headquartered in Palm Harbor, Florida.

APS Pharmacy provides pharmaceutical compounding to patients and physicians nationwide across 48 states. The company focuses primarily on hormone replacement therapy (injectable testosterone); as well as compounds for autism, opioid addiction, intravenous nutritionals, nootropics (substances that enhance mental skills); allergies; and erectile dysfunction. APS, a 503A pharmacy, was founded in 2005 and is headquartered in Palm Harbor, Florida.

“APS’ business is highly complementary to ours,” said Belmar CEO Dave Hill. “At Belmar – through the 503A compounding pharmacy and 503B pellet manufacturing business – we can provide patients with “solid dose form” hormone replacement therapy (HRT). APS primarily focuses on the “sterile injectable” aspect of HRT—this merger will help us expand our product offering to service all of our customers’ needs.”

“Belmar Pharmacy values our partnerships with our clients and the communities we serve,” said Jaime Rios, president of APS Pharmacy. “We chose to merge with Belmar Pharmacies so that we can continue to meet the growing demands of our industry, and potentially expand the services we offer to those in need. Belmar’s values, standards and quality of service reflect those of APS Pharmacy, making this merger a natural fit.”

Webster invests in branded consumer and healthcare services companies with EBITDAs from $3 million to $15 million and transaction values from $15 million to $200 million. In August 2018, the firm held a final and oversubscribed closing of Webster Capital IV LP at its hard cap of $875 million. Webster was founded in 2003 and is based in the Boston suburb of Waltham, Massachusetts.

Webster invests in branded consumer and healthcare services companies with EBITDAs from $3 million to $15 million and transaction values from $15 million to $200 million. In August 2018, the firm held a final and oversubscribed closing of Webster Capital IV LP at its hard cap of $875 million. Webster was founded in 2003 and is based in the Boston suburb of Waltham, Massachusetts.

MedEquity Capital, which has co-invested with Webster before, invests in healthcare services, distribution and products companies that have revenues of $1.5 million to $20 million and EBITDA of $0.5 million to $4 million. MedEquity is based west of Boston in Wellesley Hills, Massachusetts.

MedEquity Capital, which has co-invested with Webster before, invests in healthcare services, distribution and products companies that have revenues of $1.5 million to $20 million and EBITDA of $0.5 million to $4 million. MedEquity is based west of Boston in Wellesley Hills, Massachusetts.

Private Equity Professional | July 1, 2020

The post Webster and MedEquity Expand BelMar appeared first on Private Equity Professional.