According to a new study by Willis Towers Watson (WTW), private equity-owned companies appear to be weathering the impact of the COVID-19 pandemic across multiple sectors and geographies.

According to a new study by Willis Towers Watson (WTW), private equity-owned companies appear to be weathering the impact of the COVID-19 pandemic across multiple sectors and geographies.

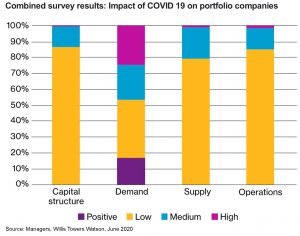

According to WTW, despite the subdued operating environment in the first half of 2020, there has been little evidence of forced portfolio company exits within private equity. The results revealed the significant turmoil in capital markets had little effect on the capital structures of portfolio companies, with 87% of respondents saying their holdings were unlikely to breach covenants; and only 13% said holdings were either close, or likely to, breach covenants in the next 2 to 3 months.

Regarding customer demand for products or services, responses however were far more varied with 46% of respondents reporting their holdings were feeling a medium-to-high impact from the slowdown in global economies, mostly within the consumer discretionary, industrials, energy, and materials sectors. In contrast, sentiment among commercial services firms remained robust, while 20% of consumer staples firms even reported a positive impact on demand.

“Private equity-owned companies have a number of structural advantages that may have enabled them to navigate this crisis,” said Jon Pliner, the US head of delegated portfolio management at WTW. “In addition to the expertise provided by private equity managers, the additional access to equity and debt capital from their sponsors may also have provided some respite.”

“Private equity-owned companies have a number of structural advantages that may have enabled them to navigate this crisis,” said Jon Pliner, the US head of delegated portfolio management at WTW. “In addition to the expertise provided by private equity managers, the additional access to equity and debt capital from their sponsors may also have provided some respite.”

The impact on businesses’ supply chains and their own internal operations also remained small, with around 80% of respondents showing low levels of concern on either point, indicating most private equity-held businesses effectively implemented alternative working arrangements to work around any disruptions arising from the COVID-19 pandemic.

“While the first half of the year showed a subdued environment for exit deals, managers have been able to maintain significant flexibility over the timing and the terms of company exits. As a result, we have seen little evidence of forced exits by private equity firms into a depressed market,” added Mr. Pliner. “Beyond the short-term dislocation, we also see several opportunities where we can continue to deploy capital, notably in technology, healthcare, and consumer staples. With deal volumes depressed, there appears to be far less competition for opportunities and as a result, potentially better entry pricing.”

London-headquartered Willis Towers Watson (NASDAQ: WLTW) was formed in January 2016 through the merger of London-based Willis Group and Arlington, Virginia-based Towers Watson. The company is a provider of risk management, insurance brokerage, and advisory services and is one of the largest insurance brokers in the world.

Private Equity Professional | July 15, 2020

The post PE Weathering COVID-19 appeared first on Private Equity Professional.