3Phase Elevator, a portfolio company of Fort Point Capital, has acquired Low Rise Elevator.

3Phase Elevator, a portfolio company of Fort Point Capital, has acquired Low Rise Elevator.

Low Rise is based near Philadelphia in Lima, Pennsylvania and provides maintenance, repair, and modernization services to customers in the Philadelphia metropolitan area, Northern Delaware, and Southern New Jersey. The company is led by President Mark Myers.

“Low Rise is an independent business and our customers choose us for their ability to reach us 24 hours a day, 7 days a week,” said Mr. Myers. “As a fellow independent elevator company, 3Phase approaches business the same way, and that is why we are excited to join them.” Following the close of the transaction, Mr. Myers will be the Branch Manager for 3Phase covering the states of Pennsylvania, Delaware, Maryland, and Virginia.

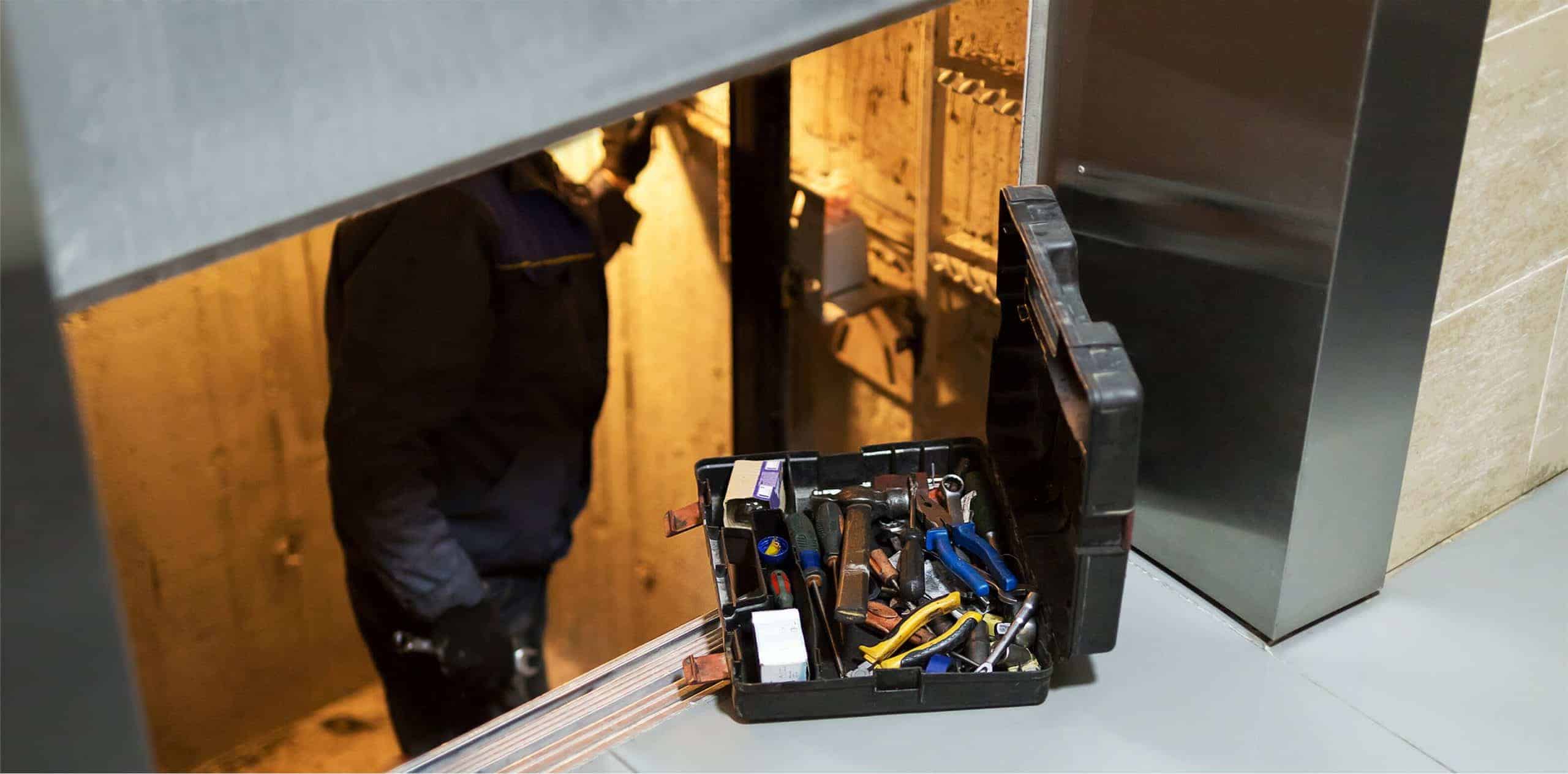

![]() 3Phase Elevator is a provider of maintenance, repair, and modernization services for all major brands of elevator and escalator equipment. The company was founded in 1996 and is led by CEO Mike Strachan.

3Phase Elevator is a provider of maintenance, repair, and modernization services for all major brands of elevator and escalator equipment. The company was founded in 1996 and is led by CEO Mike Strachan.

Fort Point Capital acquired 3Phase in April 2018. The buy of Low Rise follows the earlier add-on acquisitions of Allied Elevator, a Danvers, Massachusetts-based provider of elevator repair and maintenance services throughout the Boston metro area, in August 2018; and Excel Elevator, a Staten Island, New York-based provider of elevator repair and maintenance services serving New Hampshire, Massachusetts, Connecticut, New York, Pennsylvania, New England, Maryland and Florida, in December 2019.

“3Phase’s acquisition approach continues to ensure the shared success of the customers and employees. Low Rise is a strong competitor in the Philadelphia market. Their customer-first approach and track record really impressed the 3Phase leadership team,” said Mr. Strachan. “3Phase Elevator is quickly becoming the acquisition partner of choice for the best elevator companies in the Eastern United States.”

“We are pleased that our goal of building the leading independent elevator company resonated with Mark and the Low Rise team. They will be a great addition to the 3Phase family,” said Paul Lipson, a partner at Fort Point and the chairman of the board of 3Phase.

“We are pleased that our goal of building the leading independent elevator company resonated with Mark and the Low Rise team. They will be a great addition to the 3Phase family,” said Paul Lipson, a partner at Fort Point and the chairman of the board of 3Phase.

![]() Boston-based Fort Point, founded in 2010, invests from $10 million to $30 million of equity in service-oriented, lower middle-market companies that have enterprise valuations of $20 million to $75 million. Sectors of interest include business services, healthcare services, information & software, and transportation & logistics.

Boston-based Fort Point, founded in 2010, invests from $10 million to $30 million of equity in service-oriented, lower middle-market companies that have enterprise valuations of $20 million to $75 million. Sectors of interest include business services, healthcare services, information & software, and transportation & logistics.

Private Equity Professional | August 19, 2020

The post Fort Point Builds Elevator Maintenance Platform appeared first on Private Equity Professional.