Graycliff Partners has acquired its first fund four platform with the buy of Gerard Daniel Worldwide.

Graycliff Partners has acquired its first fund four platform with the buy of Gerard Daniel Worldwide.

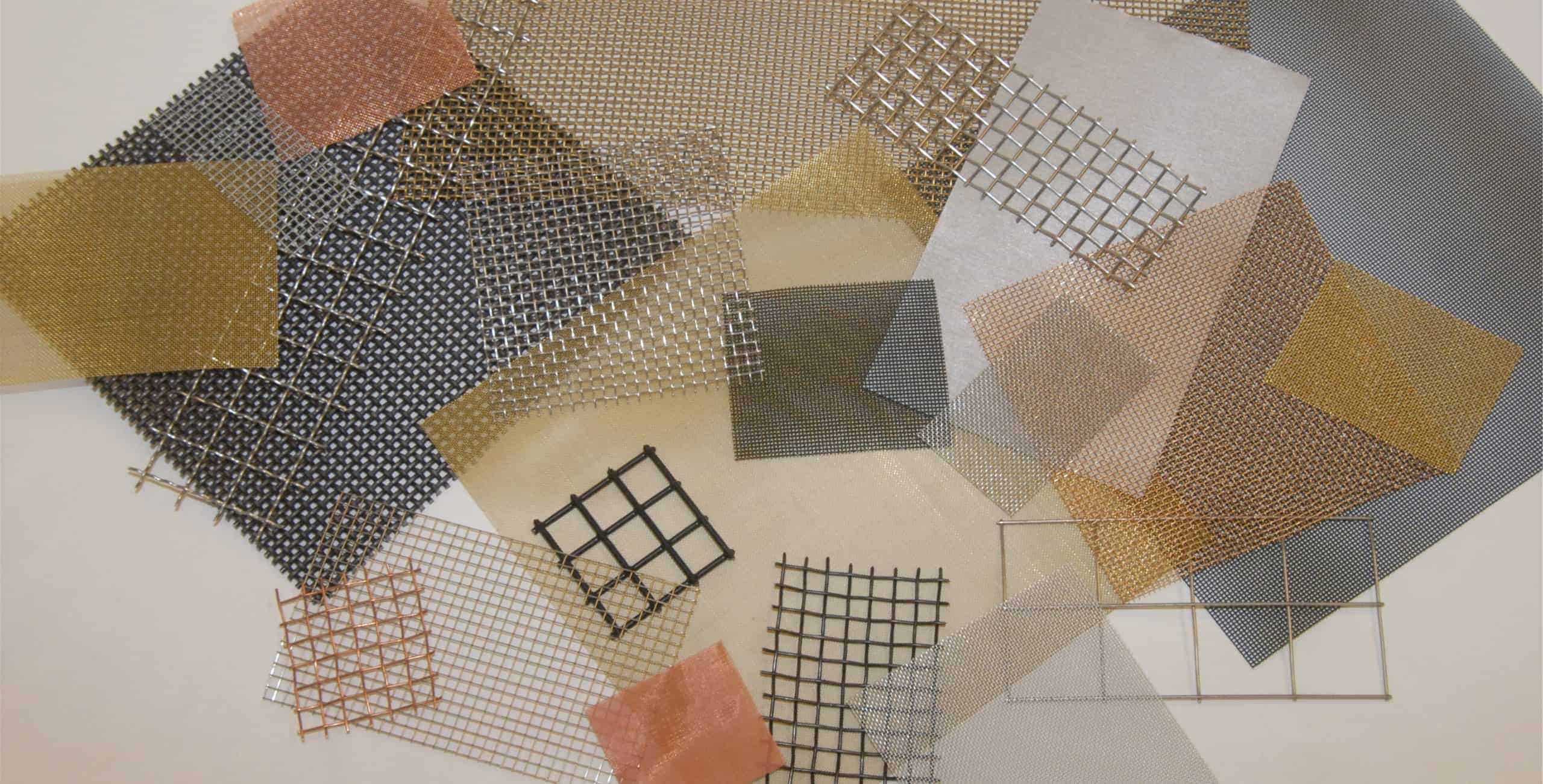

Gerard Daniel is a manufacturer and distributor of more than 5,000 SKUs of wire mesh and other wire products to over 3,000 customers worldwide. The company’s products are used with filtration, sound suppression, heat dispersion, and electrochemical applications in the automotive, aerospace, energy, pharmaceutical, electronics, food, and general manufacturing sectors.

Gerard Daniel was founded in 1952 by Gerard and Ruth Daniel and acquired in June 1987 by a private equity investor group that included CEO Gary Shultis. Today, through a combination of 20 add-on acquisitions and greenfield launches, the company operates eleven manufacturing and distribution facilities in the US, Canada, and Ireland. Gerard Daniel has more than 350 employees and is headquartered 50 miles northwest of Baltimore in Hanover, Pennsylvania.

“We realized we were at an important inflection point in our company’s history and decided it was the right time to capitalize on the market potential by bringing on a financial partner,” said Mr. Shultis. “We knew from the outset that the Graycliff team fit our culture of integrity and alignment with the enthusiasm for the growth of the business.”

With the closing of the transaction, Tim Kardish has been named as Gerard Daniel’s new chief executive officer. Prior to joining Gerard Daniel earlier last month, Mr. Kardish was the president and CEO of Sussex Wire, an Easton, Pennsylvania-based maker of highly-engineered, specialty metal parts and components. In May 2019, Sussex Wire was sold by New Spring Capital to MW Industries, a portfolio company of American Securities.

With the closing of the transaction, Tim Kardish has been named as Gerard Daniel’s new chief executive officer. Prior to joining Gerard Daniel earlier last month, Mr. Kardish was the president and CEO of Sussex Wire, an Easton, Pennsylvania-based maker of highly-engineered, specialty metal parts and components. In May 2019, Sussex Wire was sold by New Spring Capital to MW Industries, a portfolio company of American Securities.

“I look forward to joining the team at Gerard Daniel and am excited to leverage Graycliff’s experience working with middle-market industrial companies to assist us with capitalizing on our leadership position and building upon the company’s rich history. We intend to drive growth, both organically and through strategic acquisitions,” said Mr. Kardish.

“Gerard Daniel has evolved into an impressive global competitor in wire mesh applications over its 70-year history. We are excited to partner with the team through this next iteration of expansion,” said Andrew Trigg, a managing partner at Graycliff. “The strategic efforts and investment with Graycliff will help to deepen the company’s operational efficiencies through data and digital investments, expansion into new technologies like synthetic materials and applications, and effectuate and integrate strategic acquisitions.”

New York City-based Graycliff invests from $10 million to $50 million of control equity in companies with revenues of $10 million to $200 million and EBITDA of $4 million to $20 million. Sectors of interest include niche manufacturing, business services, and value-added distribution. The firm was formed in December 2011 by the former investment team of HSBC Capital. In December 2019, Graycliff held a final closing of its latest buyout fund, Graycliff Private Equity Partners IV LP, at its hard cap with $350 million of limited partner commitments.

New York City-based Graycliff invests from $10 million to $50 million of control equity in companies with revenues of $10 million to $200 million and EBITDA of $4 million to $20 million. Sectors of interest include niche manufacturing, business services, and value-added distribution. The firm was formed in December 2011 by the former investment team of HSBC Capital. In December 2019, Graycliff held a final closing of its latest buyout fund, Graycliff Private Equity Partners IV LP, at its hard cap with $350 million of limited partner commitments.

Private Equity Professional | September 1, 2020

The post Graycliff Closes First Fund IV Buy appeared first on Private Equity Professional.