Artemis Capital Partners has acquired Omega Optical, a maker of optical filters and coatings.

Artemis Capital Partners has acquired Omega Optical, a maker of optical filters and coatings.

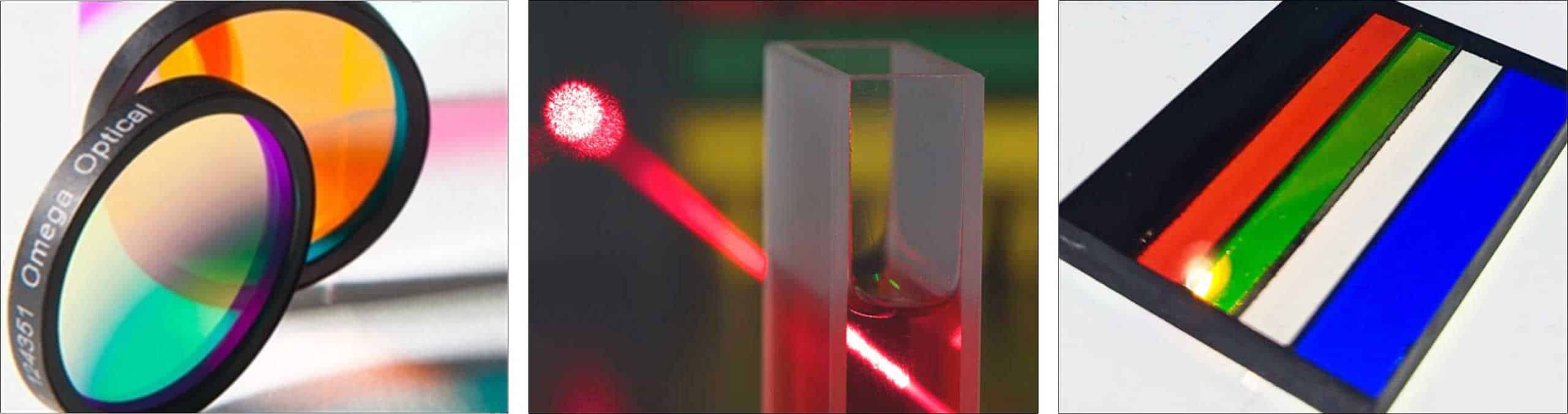

Omega Optical’s products are used to control the passage of light to enable a range of optical applications including flow cytometry (to study cells and molecules), fluorescence microscopy (to study organic or inorganic substances), spectroscopy (to study matter and electromagnetic radiation), LiDAR (to measure distances using laser light), machine vision, and satellite imaging.

Customers of the company include original equipment manufacturers in the life science, aerospace & defense, instrumentation, semiconductor, environmental and industrial sensor industries. Omega was founded by Dr. Robert (Bob) Johnson in 1969 and is headquartered 100 miles northwest of Boston in Brattleboro, Vermont.

Omega’s CEO Thomas Smith and Dr. Johnson – now the company’s technical director – have both retained an equity ownership interest in the company in partnership with Artemis.

With the closing of this transaction, Artemis recruited John Ippolito, a photonics industry executive, to join the Omega Board and provide assistance with corporate development activities, including targeting and integrating future acquisitions. Mr. Ippolito was formerly a senior executive at MKS Instruments (NASDAQ: MKSI), a Boston-based provider of measurement and power control equipment used in the semiconductor, industrial, life sciences, and research sectors.

With the closing of this transaction, Artemis recruited John Ippolito, a photonics industry executive, to join the Omega Board and provide assistance with corporate development activities, including targeting and integrating future acquisitions. Mr. Ippolito was formerly a senior executive at MKS Instruments (NASDAQ: MKSI), a Boston-based provider of measurement and power control equipment used in the semiconductor, industrial, life sciences, and research sectors.

“Omega is a great first step in pursuit of building a larger optics business,” said Mr. Ippolito. “The company has a strong position in several high growth end markets that we can build upon. We intend to be active acquirers of complementary businesses to quickly get to a greater scale with an expanded product offering.”

The buy of Omega is the first company to join Artemis’s Optical Technology platform, which looks to acquire other makers of optical coatings, components, and assemblies.

“In Omega, we saw a company with an innovative culture, exceptional technical capabilities, and a desire for growth,” said Peter Hunter, a managing director at Artemis. “Omega’s deep applications expertise, OEM business model and differentiated technologies are signature characteristics of an Artemis partner company. Now more than ever, we believe that Omega is uniquely positioned to grow both organically and inorganically.”

“In Omega, we saw a company with an innovative culture, exceptional technical capabilities, and a desire for growth,” said Peter Hunter, a managing director at Artemis. “Omega’s deep applications expertise, OEM business model and differentiated technologies are signature characteristics of an Artemis partner company. Now more than ever, we believe that Omega is uniquely positioned to grow both organically and inorganically.”

![]() Artemis Capital invests in companies with revenues of $5 million to $50 million and EBITDA of $1 million to $10 million. Sectors of interest include manufacturers of differentiated industrial technologies, including aerospace, automotive, defense, energy, industrial automation, scientific and research, and medical sectors. Artemis was founded in 2010 and is based in Boston.

Artemis Capital invests in companies with revenues of $5 million to $50 million and EBITDA of $1 million to $10 million. Sectors of interest include manufacturers of differentiated industrial technologies, including aerospace, automotive, defense, energy, industrial automation, scientific and research, and medical sectors. Artemis was founded in 2010 and is based in Boston.

“With the strategic support of Artemis, we gain critical additional resources to build on Omega’s legacy here in Brattleboro,” said Mr. Smith. “Artemis’s understanding of our core markets, technology and value proposition allowed us to quickly align on the key priorities for Omega’s next phase of growth.”

“Having recently celebrated our first fifty years as a company, we are delighted to partner with Artemis and continue growing the company here in Vermont for the next fifty years,” said Dr. Johnson.

Private Equity Professional | September 16, 2020

The post Artemis Sees Future, Forms Optical Tech Platform appeared first on Private Equity Professional.