American Securities has agreed to sell Henry Company, a provider of building envelope systems, to publicly traded Carlisle Companies for nearly $1.6 billion.

American Securities has agreed to sell Henry Company, a provider of building envelope systems, to publicly traded Carlisle Companies for nearly $1.6 billion.

Henry Company is a manufacturer of roofing and building products that are used to control the flow of water, vapor, air, and energy through the entire building envelope, from foundation to roof.

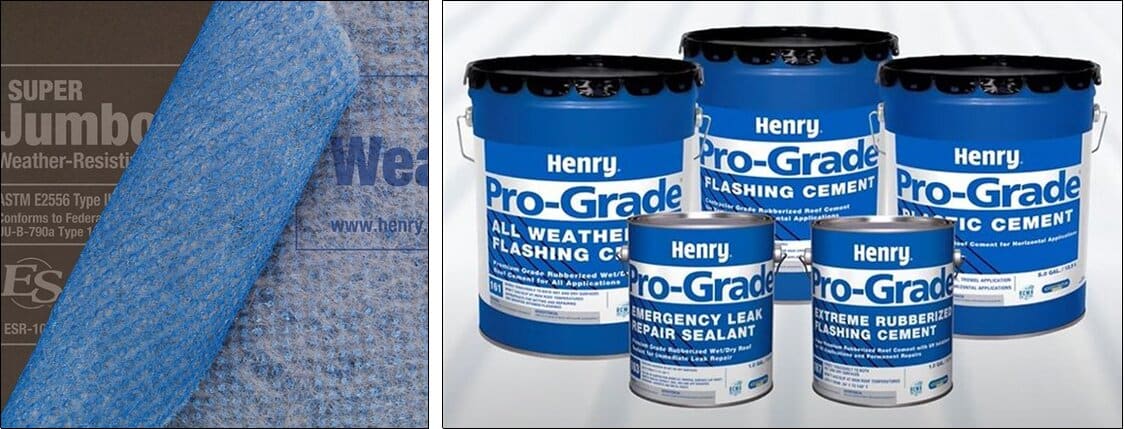

Henry’s products include roof coatings and cements, air and vapor barriers, underlayments, waterproofing products, spray foam, and green roofing systems. The company is also a supplier of wax and asphalt emulsions for a variety of OEM applications. Henry’s products are used in new construction and repair & restoration projects within the residential and commercial end markets.

Company-owned brand names include Henry (roof cements and coatings), Blueskin (air and vapor barriers), AQUA-BLOC (waterproofing), AIR-BLOC (air barriers), and JUMBO-TEX (weather-resistant barriers). Henry, led by CEO Frank Ready, operates 12 manufacturing facilities in the United States and Canada with a headquarters in El Segundo, California.

“We are excited about Carlisle’s acquisition of Henry, as we believe it is an excellent fit for Carlisle’s strategic vision,” said Mr. Ready. “We appreciate our partnership with American Securities. Their thoughtful and balanced approach worked well with our culture and the resources they provided were world-class.”

“We are excited about Carlisle’s acquisition of Henry, as we believe it is an excellent fit for Carlisle’s strategic vision,” said Mr. Ready. “We appreciate our partnership with American Securities. Their thoughtful and balanced approach worked well with our culture and the resources they provided were world-class.”

For the twelve months ending May 31, 2021, Henry had revenues of $511 million and an adjusted EBITDA of $119 million. Based on a purchase price of $1.575 billion, the EBITDA multiple on this transaction is just under 13.2x. American Securities acquired Henry in October 2016 from Graham Partners which had acquired the business in June 2012 from AEA Investors.

“We are proud of and grateful for Frank Ready and the entire Henry management team,” said Scott Wolff, a managing director at American Securities. “During our partnership, Frank and the talented management team drove significant growth and executed critical strategic initiatives. We believe that the Carlisle and Henry teams’ joint future will be successful.”

“We are proud of and grateful for Frank Ready and the entire Henry management team,” said Scott Wolff, a managing director at American Securities. “During our partnership, Frank and the talented management team drove significant growth and executed critical strategic initiatives. We believe that the Carlisle and Henry teams’ joint future will be successful.”

American Securities invests in businesses with $200 million to $2 billion of revenue and $50 million to $250 million of EBITDA. Sectors of interest include industrial manufacturing, specialty chemicals, aerospace and defense, energy, business services, healthcare, media, restaurants, and consumer products. The firm has more than $23 billion of capital under management and has offices in New York City and Shanghai.

American Securities invests in businesses with $200 million to $2 billion of revenue and $50 million to $250 million of EBITDA. Sectors of interest include industrial manufacturing, specialty chemicals, aerospace and defense, energy, business services, healthcare, media, restaurants, and consumer products. The firm has more than $23 billion of capital under management and has offices in New York City and Shanghai.

![]() Carlisle Companies (NYSE: CSL) designs, manufactures and markets a range of products for the commercial roofing, energy, agriculture, lawn and garden, mining and construction equipment, aerospace and electronics, dining and food delivery, and healthcare sectors. The company had revenues in FY2020 of $4.2 billion and is headquartered in Scottsdale, Arizona.

Carlisle Companies (NYSE: CSL) designs, manufactures and markets a range of products for the commercial roofing, energy, agriculture, lawn and garden, mining and construction equipment, aerospace and electronics, dining and food delivery, and healthcare sectors. The company had revenues in FY2020 of $4.2 billion and is headquartered in Scottsdale, Arizona.

The buy of Henry by Carlisle is expected to close in the third quarter of 2021.

© 2021 Private Equity Professional | July 20, 2021