Gauge Capital has acquired NINJIO, a provider of cybersecurity awareness training services, in partnership with the company’s owners and senior management team.

Gauge Capital has acquired NINJIO, a provider of cybersecurity awareness training services, in partnership with the company’s owners and senior management team.

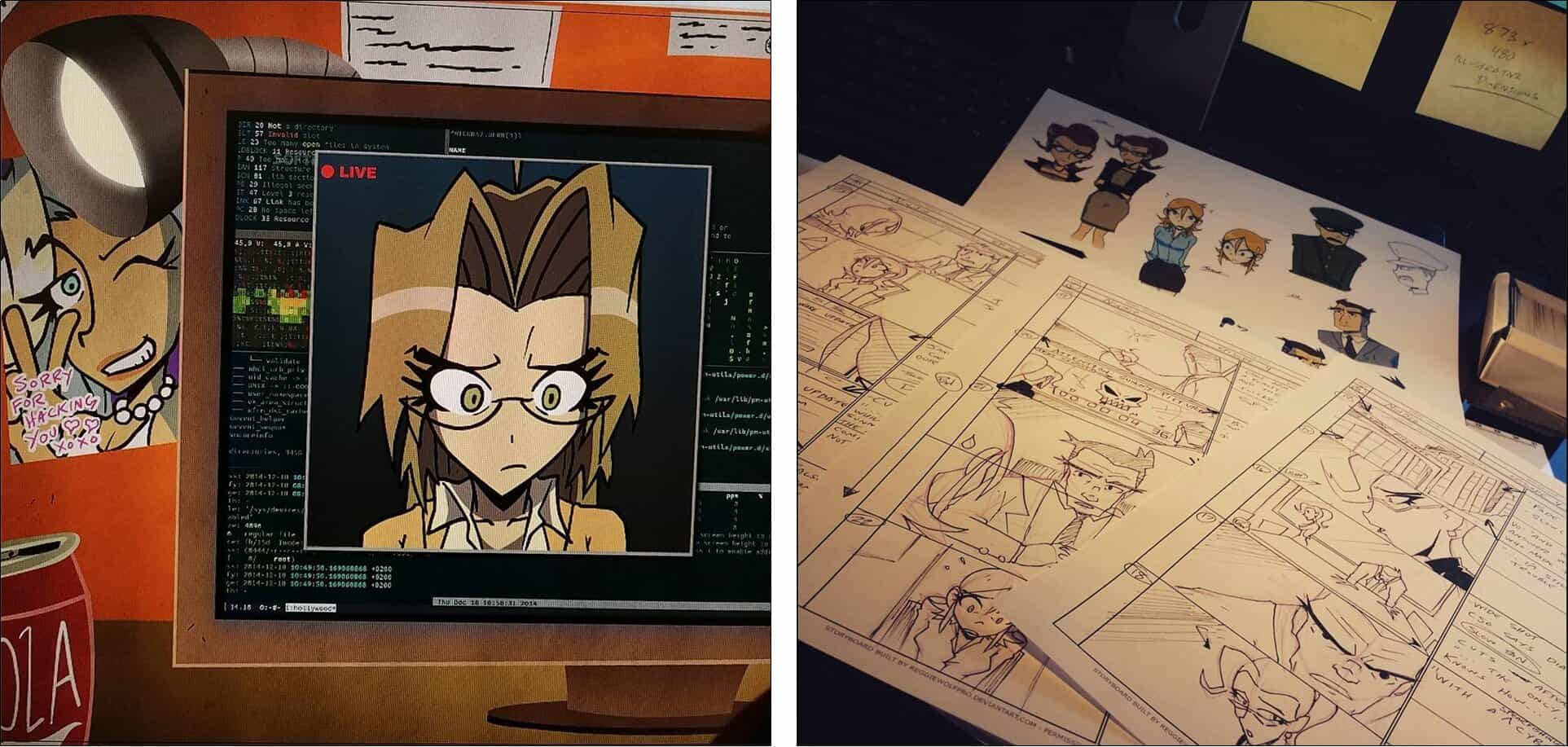

NINJIO’s services include three to four-minute micro-learning videos that teach organizations, employees and families about cybersecurity, breaches, and how to avoid cyber threats.

NINJIO’s videos are based on or inspired by companies that have experienced actual and significant security breaches. The company’s animated content is released every 30 days and focuses on current and prolific security threats.

In 2021, NINJIO launched NINJIO PHISH, a natively integrated phishing simulator that is used to test and quantify human cyber vulnerabilities. Phishing is the fraudulent practice of sending emails purporting to be from reputable companies to induce individuals to reveal personal information, such as passwords and credit card numbers. Phishing is considered one of the largest cyberthreats to businesses and consumers worldwide. NINJIO PHISH allows a company to send benign simulated phishing attacks to its employees, track their actions, and quantify, analyze, and report the data back to the company’s senior IT staff.

NINJIO was founded in 2015 by CEO Zack Schuler and is headquartered near Malibu in Westlake Village, California.

“We look forward to partnering with Gauge Capital and are excited about the resources they bring to the table,” said Mr. Schuler. “With a proven track record and extensive network in the tech-enabled education and training space, we knew from day one that Gauge was the right partner for NINJIO in terms of strategy, fit and goals for the business.”

“We look forward to partnering with Gauge Capital and are excited about the resources they bring to the table,” said Mr. Schuler. “With a proven track record and extensive network in the tech-enabled education and training space, we knew from day one that Gauge was the right partner for NINJIO in terms of strategy, fit and goals for the business.”

“We have been impressed with what Zack and the rest of the NINJIO team have built and are excited about the company’s mission to equip every-day people with the knowledge they need to protect themselves against cyberthreats,” said Tom McKelvey, a co-founder and managing partner at Gauge Capital. “NINJIO has established a reputation of excellence through its unique and engaging content, and we look forward to achieving our shared vision for growth.”

“We have been impressed with what Zack and the rest of the NINJIO team have built and are excited about the company’s mission to equip every-day people with the knowledge they need to protect themselves against cyberthreats,” said Tom McKelvey, a co-founder and managing partner at Gauge Capital. “NINJIO has established a reputation of excellence through its unique and engaging content, and we look forward to achieving our shared vision for growth.”

Headquartered near Dallas in Southlake, Texas, Gauge Capital makes control and shared-control investments in North American-based companies that have $5 million to $40 million of EBITDA. Typical transaction types include buy-outs, recapitalizations, divestitures, privatizations, consolidations, and growth capital investments. Sectors of interest include technology, industrial, business services, healthcare services, consumer, and food.

Headquartered near Dallas in Southlake, Texas, Gauge Capital makes control and shared-control investments in North American-based companies that have $5 million to $40 million of EBITDA. Typical transaction types include buy-outs, recapitalizations, divestitures, privatizations, consolidations, and growth capital investments. Sectors of interest include technology, industrial, business services, healthcare services, consumer, and food.

Vista Point Advisors, a San Francisco-based investment bank, was the financial advisor to NINJIO.

© 2021 Private Equity Professional | July 22, 2021