Private equity ramps up divestment efforts

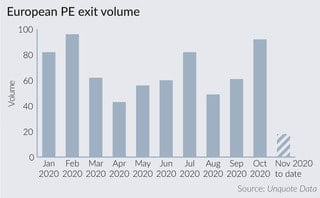

Following another period of lacklustre exit activity in Q3, even as deployment was picking up, October saw a notable spike in divestments by PE players across Europe.

Following another period of lacklustre exit activity in Q3, even as deployment was picking up, October saw a notable spike in divestments by PE players across Europe.

Opalesque Industry Update - The Eurekahedge Hedge Fund Index was down 0.16% in October 2020, outperforming the global equity market as represented by the MSCI ACWI (Local), which lost 2.29% over the same period. Global

Paris-based private equity and infrastructure investor Omnes has made its first Irish renewables deal by backing solar PV developer Power Capital Renewable Energy.

Mid-market Chicago buyout house CIVC Partners has celebrated its 50th year in of investing by sealing a hard cap-beating $525m final close for its sixth flagship fundraise.

Credit and distressed investment specialist Värde Partners has hauled in a target-busting $1.6bn for a new Covid-19 dislocation fund, just a year after raising its biggest-ever flagship buyout fund.

Silver Lake spinout Sumeru Equity Partners has soared past its Fund III goal to haul in $720m for a final close of the investment vehicle.

Coherent, which helps insurers build digital-first services, has scored $14m in its Series A funding round.

Schroders Group impact investor BlueOrchard Finance has launched a $350m-targeting fund looking to support frontier market small and micro-businesses struggling amid the coronavirus pandemic.

Apse Capital has acquired TerraQuest Solutions, a developer of land, planning and data technology software, for a maximum valuation of £72m.

Hg has sold German data management specialist Eucon Group to insurance company VHV Group.

Spanish venture capital newcomer All Iron Ventures has made an impressive start by raising the biggest debut VC fund in the country ever.

Seed and early-stage investment house Cottonwood Technology Fund has hit a first close for its third fund, which is eyeing up to €100m in total.

Farmland investor Homestead Capital has almost doubled its assets under management to over $1bn through the final close of its third flagship fund.

Lower mid-market private equity house Graham Partners has soared to a $937m hard cap final close for its fifth flagship private equity fundraise.

Chinese private equity player Hony Capital has reportedly hit a final close for its debut venture capital fundraise as it begins a diversification of its investment offerings.

New Mexico-based Tramway Venture Partners is out raising its debut fund, with a focus on biotech, medtech and healthtech deals.

Transaction sees Ardian exiting four-year co-investment in Envision

Mid-market Chicago buyout house CIVC Partners is back in the fundraising market for what could be its biggest-ever investment vehicle.

Recent Comments