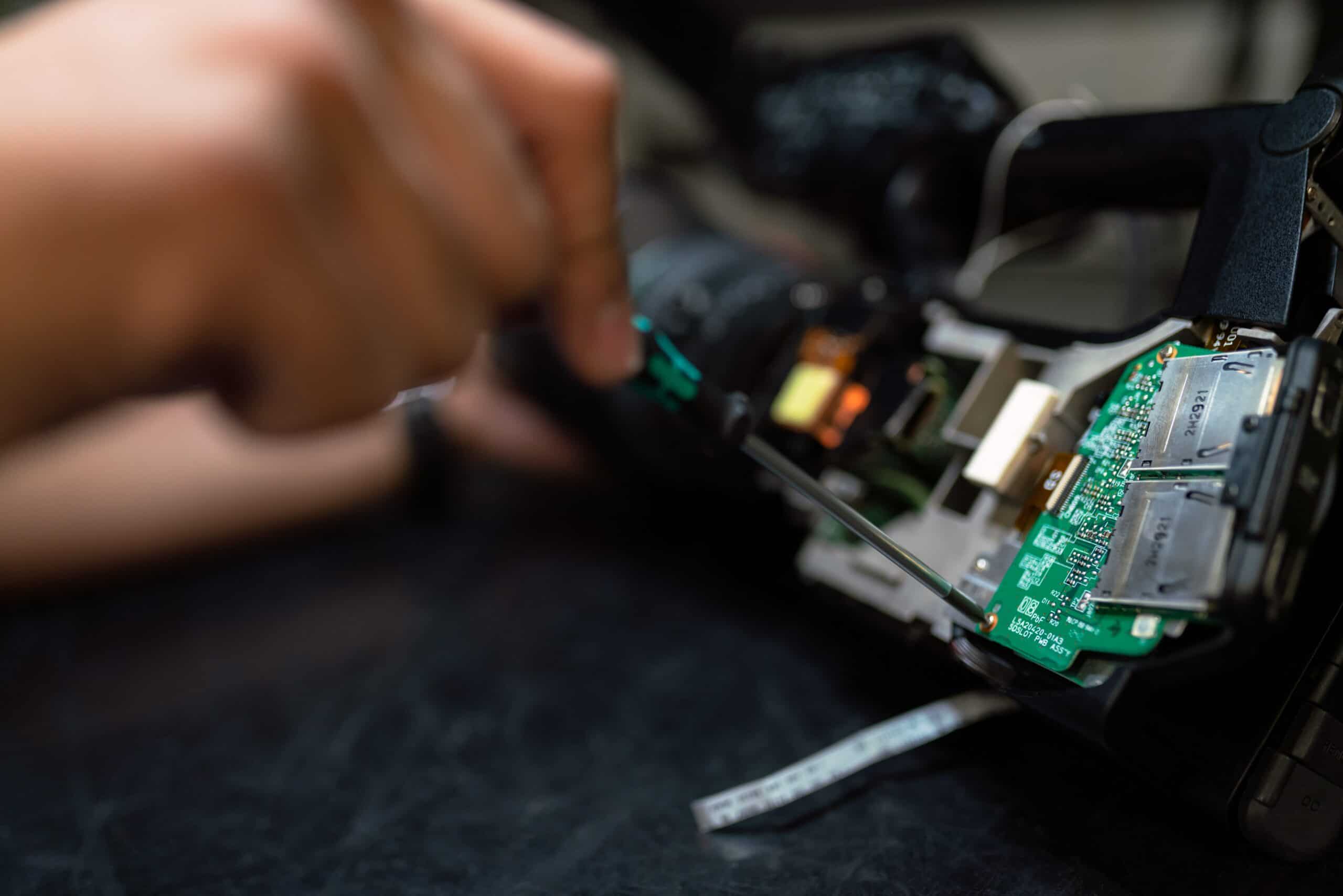

Cotton Creek Capital Captures ConeCraft

Cotton Creek Capital has acquired ConeCraft, a maker of equipment used in the pharmaceutical and biopharmaceutical industries. ConeCraft specializes in manufacturing stainless steel bins, mixers, bioreactors, and tube management systems that are used for research