Secondaries market set to rebound in 2021 as buyers predict record volume – Setter Capital

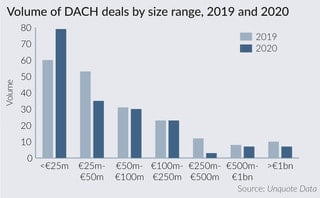

The global secondaries market is set to rebound to record levels this year after market volume slumped by 27% in 2020 due to the Covid-19 crisis, new research suggests.