Outer, Santa Monica-based Sustainable Outdoor Living Brand Raises $4.3 Million in Series Seed Funding Round

B. G., Opalesque Geneva: This is our regular report on hedge funds and alternative asset managers who are successfully protecting assets and outperforming the markets during the first months of 2020. Good ESG equit...Article Link

Laxman Pai, Opalesque Asia: New research suggests that the coronavirus could have impacted private equity firms as the buyout fundraising in the US for the first quarter of 2020 declined by almost 50 percent QoQ

New research suggests that the coronavirus could have impacted private equity firms desire to close buyout fundraising deals. Having looked at data from its own platform covering the first three months of 2020, CEPRES revealed

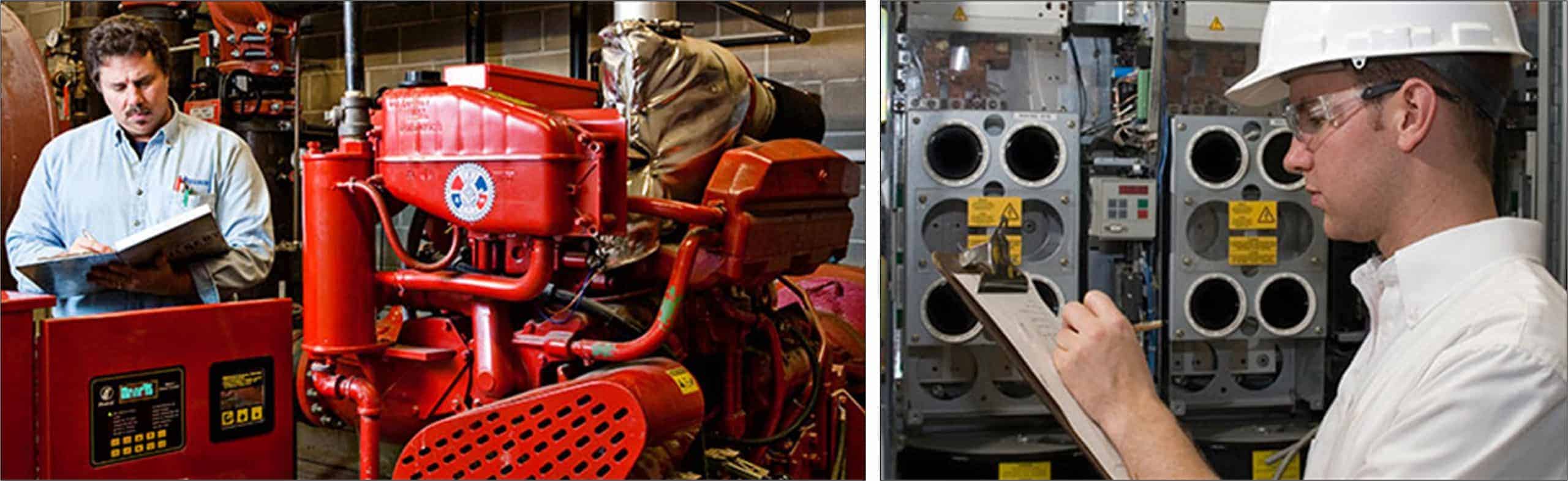

Therma Holdings, a portfolio company of Gemspring Capital, has acquired Gilbert Mechanical Contractors. Gilbert is Therma’s fourth acquisition since being acquired by Gemspring in June 2017. Gilbert is a provider of mechanical, electrical, plumbing, controls,

Tanknology, a portfolio company of Hamilton Robinson Capital Partners since September 2019, has acquired Compliance Testing & Technology (CCT). CCT is a provider of underground storage tank (UST) and aboveground storage tank (AST) compliance services,

Zamo Capital has invested in investment manager Social and Sustainable Capital (SASC).

Sustainable food chain-focused private equity firm Paine Schwartz Partners (PSP) has invested $150m into AgroFresh Solutions.

The investment in UK-based Social and Sustainable Capital (SASC) is in response to a pandemic-driven rise in demand

Despite the market expected to see declines in revenue following the impact of the coronavirus, investors are still seeking new deal opportunities, a report from Mazars claims.

The green bond market lets investors scrutinise the way issuers use their money, promoting good behaviour. Now, the focus is turning to the middle men: the banks. It is a welcome iteration, given their importance

TSG Consumer Partners (TSG) has promoted Erik Johnson and Ed Wong to managing director. Both Mr. Johnson and Mr. Wong are based in New York. “Erik and Ed have been an integral part of our

A factor in the market’s growth has been the rise of large private equity funds from major institutions such as TPG and KKR

The International Finance Corporation (IFC) has launched the first systematic process by an issuer to formally integrate environmental, social and governance (ESG) considerations into choosing its bookrunners. Senior funding officials and sustainability bankers have welcomed

Participants in the sustainable bond market are considering allowing issuers to publish their sustainability frameworks after issuing bonds, instead of before. This would be a major change in market practice.

Sweden’s EQT, the private equity company, has signed the largest ever environmental, social and governance (ESG)-linked subscription credit facility, raising hopes that the structure could become more common among PE firms.

Chemtron Corporation, a portfolio company of Kinderhook Industries, has acquired Vexor Technology, a provider of non-hazardous waste processing services and alternative energy products. The buy of Vexor is the first add-on acquisition for Chemtron since

The borrowing facility is currently at €2.3bn and has an upper limit of €5bn

The vast majority of private equity LPs are seeing proactive engagement from GPs on the impact of the coronavirus crisis on their portfolios, new research shows.

Recent Comments