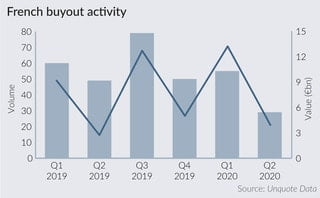

AMB :- North America M&A performance and volume lag behind rest of world during H1 2020

Laxman Pai, Opalesque Asia: North America experienced the sharpest fall in M&A performance by some margin, said a report. The impact of the COVID-19 pandemic on deal-making in the first six months of 2020 was