No sweat: banks exit long-held PureGym bridge in perfect market window

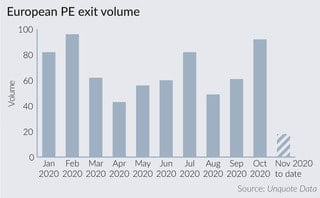

Market euphoria following news of Pfizer’s potential Covid vaccine created a perfect window for lead banks Barclays and Jefferies to sell out of a bridge loan for UK fitness chain PureGym, which they had held