BlueHalo, a portfolio company of Arlington Capital Partners, has agreed to acquire Design & Development Engineering Service Corporation (DDES).

BlueHalo, a portfolio company of Arlington Capital Partners, has agreed to acquire Design & Development Engineering Service Corporation (DDES).

DDES designs and manufactures electronic systems for Class-A spacecraft (high priority, minimum risk) used in the military and national security industries. The company’s specialized electronic systems are capable of operating unattended for many years in a hostile radiation environment. Since founding in 2003 by Steve Kephart, Glenn Lommasson, Tim Canales and Rick Ranger, DDES has produced over 250 electronic systems that have been used in orbiting spacecraft.

BlueHalo was formed by Arlington Capital in October 2020 to combine its portfolio company Aegis Technologies (acquired in October 2019) with Applied Technology Associates and Brilligent Solutions. The buy of DDES by BlueHalo follows the December 2020 add-on acquisitions of Maryland-headquartered signal intelligence and cyber engineering firms Base2 Engineering and Fortego.

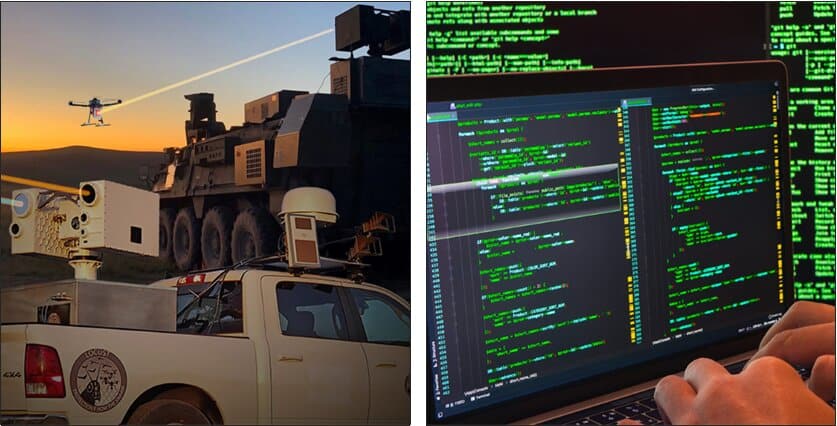

Today, BlueHalo operates as a national security platform serving the space-qualified hardware, directed energy, missile defense, cyber and intelligence, and C4ISR markets (C4ISR stands for Command, Control, Communications, Computers (C4), Intelligence, Surveillance and Reconnaissance (ISR)). BlueHalo is headquartered in Arlington, Virginia and is led by CEO Jonathan Moneymaker.

“DDES has established itself as a leader in developing space-qualified hardware and we are incredibly excited to partner with the DDES management team as we expand our space manufacturing capabilities and continue to provide unique, world-class solutions for our customers,” said Mr. Moneymaker. “BlueHalo is leading the transformation of modern warfare and the acquisition of DDES is an important addition to BlueHalo as we continue to grow organically into new mission areas.”

“DDES has established itself as a leader in developing space-qualified hardware and we are incredibly excited to partner with the DDES management team as we expand our space manufacturing capabilities and continue to provide unique, world-class solutions for our customers,” said Mr. Moneymaker. “BlueHalo is leading the transformation of modern warfare and the acquisition of DDES is an important addition to BlueHalo as we continue to grow organically into new mission areas.”

“The acquisition of DDES will build upon BlueHalo’s exceptional space capabilities and further expand the company’s presence in Albuquerque, one of BlueHalo’s core locations and a great community in which we are looking to invest further,” said David Wodlinger, a partner at Arlington Capital. “BlueHalo continues to make significant investments in engineering talent and specialized facilities in order to better serve important missions in space, and we are delighted to have DDES join the team.”

“The acquisition of DDES will build upon BlueHalo’s exceptional space capabilities and further expand the company’s presence in Albuquerque, one of BlueHalo’s core locations and a great community in which we are looking to invest further,” said David Wodlinger, a partner at Arlington Capital. “BlueHalo continues to make significant investments in engineering talent and specialized facilities in order to better serve important missions in space, and we are delighted to have DDES join the team.”

![]() Chevy Chase, Maryland-based Arlington Capital was founded in 1999 and has completed over 90 acquisitions since its inception. Sectors of interest include government-regulated industries and adjacent markets including aerospace and defense; government services; and technology, healthcare, and business services.

Chevy Chase, Maryland-based Arlington Capital was founded in 1999 and has completed over 90 acquisitions since its inception. Sectors of interest include government-regulated industries and adjacent markets including aerospace and defense; government services; and technology, healthcare, and business services.

Arlington Capital is currently investing out of Arlington Capital Partners V LP, a $1.7 billion fund that closed in June 2019. In February 2021, Goldman Sachs Asset Management (GSAM) made a non-voting minority equity investment in Arlington Capital.

© 2021 Private Equity Professional | July 16, 2021

Recent Comments