Unquote tallies the top 10 most active GPs across the European buyout space amid the coronavirus turmoil.

Read MoreThe German company is expected to generate revenues of close to €100m in 2020

Read MoreAs the coronavirus crisis continues to rage across the glove, private equity investors are being forced to think more carefully about managing their existing portfolios amid a volatile dealmaking market. AltAssets spoke to Eaton Partners'

Read MoreNordic Capital has acquired a majority stake in German company BearingPoint's regulatory tech subsidiary RegTech.

Read MoreWhile advisers readied themselves for a wave of distressed opportunities off the back of the coronavirus crisis – and GPs anticipated a shift in LP allocation strategies – the turnarounds surge has failed to materialise.

Read MoreFrench GP LBO France has completed the sale of FH Ortho to Japanese trade buyer Olympus Corporation.

Read MoreGPs' relationships with their existing banks and debt funds became crucial to navigating challenging liquidity situations and potential covenant breaches in Q2, and will be even more important in managing the ongoing consequences of the

Read MoreSecondaries activity is recovering from the initial coronavirus-related shock, with good prospects for GP-led secondaries deals. Harriet Matthews speaks to David Swanson of Unigestion to discuss the market outlook

Read MoreNordian Capital has acquired a majority stake in accessories producer J-Club; the GP intends to draw a line under the dispute that saw Nordian attempt to pull out of the deal as the coronavirus crisis

Read MoreDunedin-backed payments processor Global Processing Services (GPS) has drawn investment from Visa.

Read MoreHarbourVest Partners has held an oversubscribed and hard cap close of its latest secondaries fund, Dover Street X LP (Dover X), with $8.1 billion of capital commitments. The hard cap close of Dover X follows

Read MoreEuropean private equity fundraising activity has come roaring back in the third quarter thanks to a slew of big fund closes - but the coronavirus pandemic is forcing many less-established GPs out of the capital

Read MoreBlackstone's Strategic Partners arm has bought into two funds of funds vehicles managed by UK-based Method Advisors through a GP-led secondaries process.

Read MoreFollowing a turbulent first half of 2020, when Silverfleet Capital focused on portfolio management, Katharine Hidalgo speaks to head of investor relations Andrew Harrison about how the firm is emerging from survival mode to turn

Read MoreFrench GP Omnes Capital has launched its fifth Croissance mid-cap vehicle with a target of around €350m.

Read MoreFrench GPs Omnes Capital and Alliance Entreprendre have invested €10m in Sekoia, a France-based tech company specialising in cyber-threat anticipation.

Read MoreBerlin-based GP PrecapitalPartners is to acquire Germany-based bakery chain Dat Backhus, following its insolvency proceedings, which began in April 2020.

Read MoreFrench GP Sparring Capital (previously known as Pragma Capital) is aiming for a final close in the coming months for its fourth fund, having collected around two thirds of its target. Greg Gille catches up

Read MoreNetherlands-headquartered GP Egeria has hired Gregor Schmidt as an associate in its Munich office, expanding its DACH region private equity team.

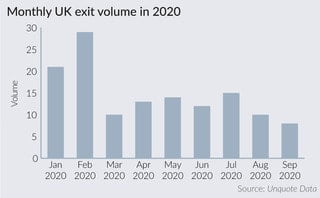

Read MoreFollowing a dramatic drop in exit activity in Q2, early figures from the third quarter suggest that very few GPs will be in sell mode for the rest of year. Katharine Hidalgo reports

Read More

Recent Comments