Berlin-headquartered Project A has promoted Christoph Rösler to partner; Rösler will co-lead the firm’s private equity co-investment practice, which sees the firm invest in PE and growth deals alongside mid-cap GPs.

Read MoreLower mid-market GP Lonsdale Capital has acquired Infrata, a London-based infrastructure consultancy firm.

Read MoreIn a fundraising market that has never been as crowded or competitive, LPs and GPs alike are contending with the need to commit and raise capital amidst macroeconomic uncertainty. Unquote explores LP preferences, GP behaviour

Read MoreParis-headquartered Access Capital Partners (ACP) has held a EUR 375m first close for its ninth flagship fund-of-funds, which will continue the GP’s strategy of investing in small-cap European buyout vehicles and secondaries.

Read MoreGerman GP Findos has sold local digital training provider Karriere Tutor to Swedish impact fund Trill just a year after it invested in the asset.

Read MoreMid-market GP Equistone has agreed to sell FirstPort, a UK-based residential property management company, to Partners Group- and TA Associates-backed European residential real estate services provider Emeria.

Read MoreSwitzerland-headquartered Patrimonium Private Equity is focusing on deployment in the DACH lower mid-market, as well as add-ons for portfolio companies including Bächler & Güttinger and Netzlink, senior directors Andreas Ziegler and Ulrich Mogwitz told Unquote.

Read MoreMirabaud Asset Management has appointed luxury and consumer industry expert Chabi Nouri as private equity partner; she will co-manage the GP's Lifestyle strategy, which expects to launch a second vintage later in 2022.

Read MoreLondon-headquartered European growth technology investor One Peak Partners has made a regulatory filing for One Peak GP III.

Read MoreMid-market GP capital D has acquired a majority stake in Phrasee, a London-based AI-powered copywriting technology group.

Read MoreAlternative investment manager Oaktree Capital Management has acquired a majority stake in London-headquartered non-dilutive LP, GP management company and portfolio financing provider 17Capital.

Read MoreBelgian GP Gimv has sold its majority stake in France-based Wolf Lingerie to PE investor NextStage AM. Co-investors BNP Développement and BPI as well as the company’s management are also investing in the deal.

Read MoreGermany-headquartered Nord Holding has announced the launch of a new DACH-focused Small-Cap Fund with a EUR 125m target and an initial EUR 50m commitment from the GP.

Read MoreBC Partners is aiming for steady deployment amidst a highly competitive market as it takes stock ahead of its next fundraise, head of investor relations Alexis Maskell told Unquote.

Read MoreBC Partners is aiming for steady deployment amidst a highly competitive market as it takes stock ahead of its next fundraise, head of investor relations Alexis Maskell told Unquote.

Read MoreWind Point Partners is reportedly already eyeing up to $1.7bn for its tenth flagship fundraise, just over a month after Goldman Sachs GP stake investment arm Petershill bought into the firm. The post Wind Point

Read MoreEuropean mid-market GP Gilde Buy Out Partners has announced its rebrand to Rivean Capital.

Read MorePictet Alternative Advisors (PAA) has held a first close for its healthcare fund-of-funds towards its target of USD 400m, the GP told Unquote.

Read MoreSpanish GP Henko Partners is planning to return to market for its next fund as early as 2023 as it moves to fully deploy of its debut vehicle, partner Lars Becker and vice-president Ricardo Mellado

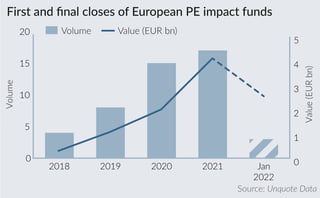

Read MoreEuropean GPs raised EUR 4.1bn across 17 first and final closes in 2021 for vehicles focusing on impact-driven investments, with EUR 2.56bn raised in January 2022 alone, according to Unquote Data.

Read More

Recent Comments