Hunter Point Capital, launched last year by the co-founder of Blackstone’s GSO credit platform to take stakes in mid-market alternative asset managers, has hired Melvin Hibberd as a managing director. The post Hunter Point brings

Read MoreBerlin-headquartered DACH-focused mid-market GP Capiton has held a final close for Capiton VI on EUR 504m.

Read MoreGlobal buyout giant Blackstone has held a $5.6bn final close for its second fund in GP stakes. The post Blackstone closed $5.6bn GP Stakes Fund II to take long-term minority investments in PE firms first

Read MoreCommercial real estate PE firm Longpoint Realty Partners has beat its hard cap to close its second fund on $669m, almost 50% above its initial target of $450m. The post Longpoint Realty Partners beat hard

Read MoreFollowing the EUR 932m final close of its third fund, Adelis Equity Partners executives Jan Åkesson and Adalbjörn Stefansson speak to Unquote about the GP's virtual fundraise and future deployment plans

Read MoreFollowing the EUR 932m final close of its third fund, Adelis Equity Partners executives Jan Åkesson and Adalbjörn Stefansson speak to Unquote about the GP's virtual fundraise and future deployment plans

Read MoreBlackstone has bought into Boston-based private equity house Great Hill Partners as the latest purchase through its GP stakes investment unit. The post Blackstone buys into Great Hill Partners as its latest private equity GP

Read MoreGlobal private equity investor Baird Capital sees opportunities to source further deals in the UK despite valuation inflation over the past 12-18 months, partner Andrew Ferguson tells Min Ho

Read MoreGlobal private equity investor Baird Capital sees opportunities to source further deals in the UK despite valuation inflation over the past 12-18 months, partner Andrew Ferguson tells Min Ho

Read MoreUnquote looks back at how the travel and leisure sector has fared, and speaks with Gaëlle d’Engremont, partner and head of the food & consumer team at PAI Partners, about the GP's recent deal for

Read MorePrivate equity and credit investment major MidOcean Partners has sold a minority stake in itself to Hunter Point Capital to "position it for long-term growth". The post Hunter Point Capital seals first GP stake deal

Read MoreWidespread destruction from ever-more dangerous climate change events this year has seen swaths of North America, Africa, Siberia and southern Europe consumed by wildfires, mass flooding in Germany and temperatures in Vancouver reaching 50°C. Impact investment funds have been

Read MoreChinese insurance company Ping An Insurance Group has closed Ping An Global Equity Selection Fund II and Ping An GP Opportunities Fund with a total capital commitment of $750m. The post Ping An Insurance Group

Read MorePantheon has held a final close on USD 624m for Pantheon Secondary Opportunities Fund (PSOF), its first programme that will solely target GP-led secondaries.

Read MoreGlobal investment major Pantheon has raised more than $620m to close a new fund targeting GP-led secondaries private equity deals. The post Pantheon eyes booming GP secondaries dealmaking with new $624m fund close first appeared

Read MorePhoenix Equity Partners has enjoyed a strong run of exits over recent months, while also pushing its 2016 fund closer to full deployment. Greg Gille catches up with managing partner David Burns to discuss recent

Read MoreLess than half (48%) of UK GPs report in detail on the ESG impact of their investments, according to a survey conducted by advisory firm BDO.

Read MoreFour Houston-based finance leaders have launched a new $275m private equity fund, GP Capital Partners, to extend their existing Genesis Park PE investing platform. The post Genesis Park PE team launch new $275m fund first

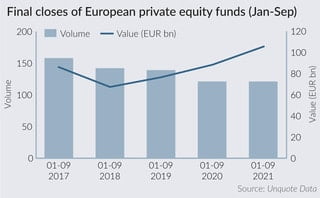

Read MoreEuropean private equity managers closed funds totalling EUR 105.5bn in commitments between January and September, a 30% increase on the average amount raised in comparable periods over the previous four years.

Read More

Recent Comments