Pictet holds first close for healthcare fund-of-funds

Pictet Alternative Advisors (PAA) has held a first close for its healthcare fund-of-funds towards its target of USD 400m, the GP told Unquote.

Pictet Alternative Advisors (PAA) has held a first close for its healthcare fund-of-funds towards its target of USD 400m, the GP told Unquote.

Finnish private equity firm Vaaka Partners has bought Medbase, a provider of databases to healthcare professionals that help to reduce adverse reactions to drugs.

Spanish GP Henko Partners is planning to return to market for its next fund as early as 2023 as it moves to fully deploy of its debut vehicle, partner Lars Becker and vice-president Ricardo Mellado

LSP has raised €1bn for the biggest European life sciences venture capital fund ever raised, which was boosted by the firm picking up investment from buyout giant EQT three months ago. The post EQT buyout

Posted by Gary Gensler, U.S. Securities and Exchange Commission, on Thursday, February 10, 2022 Editor's Note: Gary Gensler is Chair of the U.S. Securities and Exchange Commission. This post is based on his recent public

abrdn, formerly known as Aberdeen Standard Investments, has held a first close for its third core/core+ infrastructure fund on €326m with LPs from the UK, continental Europe, Japan and North America. The post abrdn holds

Charlotte-based private equity firm Falfurrias Capital Partners has made a platform investment in bank and credit union consultancy engage fi, formerly known as CU Engage. The partnership will help...(PRWeb February 09, 2022)Read the full story

Artisanal Ventures has raised $62m for its oversubscribed debut fund, which will focus on high growth B2B cloud startups. The post Artisanal Ventures looks to tap LP expertise in investing $62m debut cloud startup fund

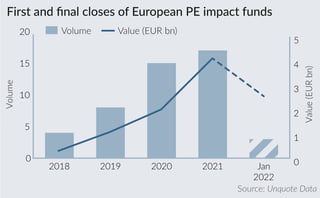

European GPs raised EUR 4.1bn across 17 first and final closes in 2021 for vehicles focusing on impact-driven investments, with EUR 2.56bn raised in January 2022 alone, according to Unquote Data.

Polaris Private Equity has hired EY as sell-side adviser on the GP's exit of Det Danske Madhus, a Danish catering company, five sources familiar with the matter said.

NGP Capital, a venture capital firm with Nokia as its sole investor, has closed Fund V with $400m funding from the technology company. The post Nokia’s venture arm NGP Capital closed $400m Fund V for

Oaktree Capital has hit a $3bn final close for its third globl real estate debt fund, making it more than a third larger than its predecessor vehicle in the strategy. The post LPs flocking to

CapMan has committed to setting ESG-linked targets as part of the science-based targets initiative (SBTI), with the aim of reaching net zero emissions across the GP and its investments.

Recent Comments