Crossing Minds Secures $10 Million Series A Financing to Help Businesses Make Smarter, Safer Recommendations

A big reason for the gains is investments with private equity firms, which in some years have received more in fees than endowments have paid out in tuition help.

More than one third (37%) of the institutional investors surveyed in Schroders' Institutional Investor Study in the spring of 2021 reported that they expected to increase their allocation to private equity in the ensuing 12

US pension giant LACERA is the latest big instutional investor to commit to Clearlake Capital's hefty new fundraise, which is reportedly targeting $10bn. The post Clearlake gets another big LP commitment towards $10bn-targeting new fund

Vendis Capital has hired Rothschild to advise on the sale of Sylphar, a Belgium-based over-the-counter (OTC) health products and cosmetics specialist, two sources familiar with the situation said.

Four Houston-based finance leaders have launched a new $275m private equity fund, GP Capital Partners, to extend their existing Genesis Park PE investing platform. The post Genesis Park PE team launch new $275m fund first

Venture Capital firm Sapphire has hired Ralph DeBernardo from mid-market private investment firm Peak Rock Capital in its newly created head of investor relations role. The post Sapphire hires Ralph DeBernardo in new head of

B. G., Opalesque Geneva: Trade finance serves as the lifeblood of day-to-day international trade by providing the fluidity and security needed to allow goods and services movement. Trade finance is known to be particular...Article Link

B. G., Opalesque Geneva: Trade finance serves as the lifeblood of day-to-day international trade by providing the fluidity and security needed to allow goods and services movement...Article Link

B. G., Opalesque Geneva: Trade finance serves as the lifeblood of day-to-day international trade by providing the fluidity and security needed to allow goods and services movement. Trade finance is known to be particular...Article Link

Institutional investors remain constructive on private capital markets amid a backdrop of rising inflation, potentially higher interest rates and increased scrutiny on ESG issues, new research from Eaton Partners shows. The post LPs eye uptick

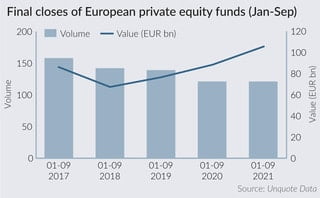

European private equity managers closed funds totalling EUR 105.5bn in commitments between January and September, a 30% increase on the average amount raised in comparable periods over the previous four years.

Recent Comments