DialPad hits $1.2bn valuation thanks to VC round, Covid-19 demand rise

AI-powered cloud business phone and contact center provider Dialpad has hit a $1.2bn valuation thanks to a new round of venture capital investment.

AI-powered cloud business phone and contact center provider Dialpad has hit a $1.2bn valuation thanks to a new round of venture capital investment.

Data and analytics platform for banks Fligoo has reportedly secured $40m in a funding round that will help it enter Brazil.

Cotton Creek Capital has acquired ConeCraft, a maker of equipment used in the pharmaceutical and biopharmaceutical industries. ConeCraft specializes in manufacturing stainless steel bins, mixers, bioreactors, and tube management systems that are used for research

New Mountain Capital has sold Gelest to Mitsubishi Chemical America, the U.S. subsidiary of Mitsubishi Chemical. Gelest is a maker of specialized organo-silicon compounds, metal-organic compounds, and silicone materials that are used in both commercial

LPs could start to feel the weight of the co-investment boom as portfolios bear the strain of Covid-19. But could it be an opportunity for others to up their game and deploy into opportunities arising

Berlin-based GP PrecapitalPartners is to acquire Germany-based bakery chain Dat Backhus, following its insolvency proceedings, which began in April 2020.

French GP Sparring Capital (previously known as Pragma Capital) is aiming for a final close in the coming months for its fourth fund, having collected around two thirds of its target. Greg Gille catches up

SK Capital has formed NuCera Solutions to acquire the specialty polymers business of Baker Hughes. NuCera produces specialty olefin polymers and high melting point polyethylene waxes that are used in adhesives, candles, coatings, imaging, personal

Snow Phipps has acquired Prototek, a provider of rapid prototyping services, from CORE Industrial Partners. Prototek’s capabilities include CNC machining, powder coating, chromating, anodizing, silk screening, and assembly. The company can prototype parts from a

Castle Harlan has sold Colyar Technology Solutions to EMS LINQ, a portfolio company of Banneker Partners. Colyar specializes in the design, development, and implementation of child nutrition, food distribution, and compliance management software. The company

Netherlands-headquartered GP Egeria has hired Gregor Schmidt as an associate in its Munich office, expanding its DACH region private equity team.

This month in Unquote: LPs could start to feel the weight of the co-investment boom as portfolios bear the strain of Covid-19. But could it be an opportunity for others to up their game and

Tree Line Capital Partners and CVC Credit Partners have provided an increase to their existing credit facility to Ingenio, a portfolio company of Alpine Investors. With the new increase, used to support an add-on acquisition

H.I.G. Capital has held an above-target close of H.I.G. Capital Partners VI LP with aggregate capital commitments of $1.3 billion. Like its five prior funds, Fund VI will invest in lower middle-market companies, primarily in

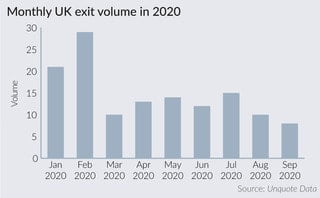

Following a dramatic drop in exit activity in Q2, early figures from the third quarter suggest that very few GPs will be in sell mode for the rest of year. Katharine Hidalgo reports

Pamlico Capital has acquired ISAAC Instruments in partnership with the company’s founders. ISAAC Instruments designs and manufactures automated telemetry and video equipment that is used by truck fleets to monitor both drivers and trucks to

Blue Sage Capital has held a final, oversubscribed, and above target closing of its third fund, Blue Sage Capital III LP, with capital of $300 million. Blue Sage’s earlier fund closed in December 2012 with

The private equity-backed aerospace services provider so far has weathered the coronavirus pandemic well, thanks partly to contracts with the Department of Defense and other US agencies

Recent Comments