Resilience Sells Brands to Scott’s

CR Brands, a portfolio company of Resilience Capital Partners, has sold its Biz Stain & Odor Eliminator (Biz) and Dryel product lines to publicly traded Scott’s Liquid Gold. The purchase price for the two product

CR Brands, a portfolio company of Resilience Capital Partners, has sold its Biz Stain & Odor Eliminator (Biz) and Dryel product lines to publicly traded Scott’s Liquid Gold. The purchase price for the two product

Guardian Capital Partners has held an oversubscribed, hard cap, and final close of its third fund, Guardian Capital Partners Fund III LP, with $282 million in capital commitments. Guardian Capital makes control investments in lower

A number of Ireland- and UK-based GPs that closed their most recent funds more than three years ago have delayed fundraises to either later in 2020 or 2021, or have altogether decided to explore new

Swedish firm Priveq Investment recently held a first and final close for its sixth fund, raising the vehicle entirely online. Partner and CEO Louise Nilsson talks to Eliza Punshi about the firm's investment strategy for

B. G., Opalesque Geneva: 68 years ago, economist Harry Markowitz formulated the Mean-Variance Efficient Frontier and a quantitative method that could help investors maximize risk-adjusted returns...Article Link

B. G., Opalesque Geneva: 68 years ago, economist Harry Markowitz formulated the Mean-Variance Efficient Frontier and a quantitative method that could help investors maximize risk-adjusted returns. According to his model ...Article Link

Newlands Capital has completed a minority investment in customer relationship management (CRM) platform Capsule, with support from Hermes GPE.

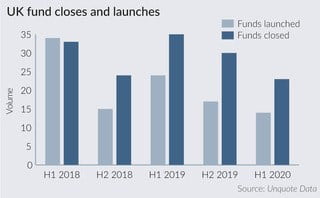

A cloud of uncertainty was placed on the private equity fundraising market back when global coronavirus lockdowns began. While a lot of theories suggested LPs would be less interested in backing funds, or be hamstrung

The Stephens Group is continuing the build of Catalyst Acoustics Group with the buy of Fräsch, the company’s fifth add-on acquisition. Fräsch is maker of polyester wall panels, ceiling treatments, baffles, dividers, partitions, and acoustic

Brookfield Asset Management has closed a US$260 million preferred stock equity investment in Superior Plus. Toronto-headquartered Superior (TSX: SPB) provides delivery, wholesale procurement and retail marketing of propane-related products, and distributes fuels including heating oil

The report comes as the government considers how to carefully pull the plug on the loan support schemes and other programmes that helped keep businesses and individuals afloat during the pandemic

Fintech startup Titanbay is hoping to open up private equity investing to small and medium-sized institutional and private investors through its newly-launched platform.

LP platform Titanbay has now launched its platform for smaller LPs to invest in private equity funds.

US pension giant CalPERS has fallen well short of its annual return goal amid its private equity investments tanking due to the coronavirus.

Limited partners are increasingly turning to debt and mezzanine infrastructure funds as they hunt for relatively safe havens for their investments amid the ongoing Covid-19 pandemic.

The scale at which the European private equity industry has been besieged by the coronavirus crisis is becoming increasingly clear thanks to new data from PitchBook, with fundraising, dealmaking and exit activity all falling to

A $250m-targeting private equity fund looking to back minority-owned businesses has been launched by the US-based Minority Wealth Commission.

PPE and infection control specialist Medicom has picked up a loan from existing investor CDPQ to help expand the business into Asia.

Recent Comments