Former UK government minister Gyimah among Lakestar appointments

European venture capital firm Lakestar has has hired former UK government minister Sam Gyimah as venture partner in the UK, and promoted and hired people in its Berlin office.

European venture capital firm Lakestar has has hired former UK government minister Sam Gyimah as venture partner in the UK, and promoted and hired people in its Berlin office.

European buyout major Eurazeo has formed a strategic partnership with Canadian Public Sector Pension Investment Board. The duo will invest up to €300m of equity in hotel assets as a first step, with each investing

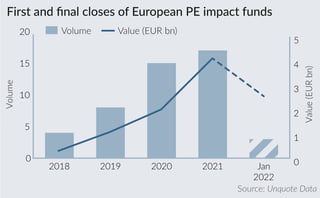

European GPs raised EUR 4.1bn across 17 first and final closes in 2021 for vehicles focusing on impact-driven investments, with EUR 2.56bn raised in January 2022 alone, according to Unquote Data.

Paris-based private equity firm EIM Capital has wholly acquired Bonna Sabla, a France-based precast concrete products provider, from Bain-backed European industrials group Consolis.

NGP Capital, a venture capital firm with Nokia as its sole investor, has closed Fund V with $400m funding from the technology company. The post Nokia’s venture arm NGP Capital closed $400m Fund V for

Spanish alternative asset manager Clave has launched an €80m fundraise targeting early-stage technology transfer projects linked to knowledge-generating centers in the healthcare field. The post Spain’s Clave launches €80m-targeting fundraise aimed at healthcare tech knowledge first

Blackstone Group has started preparations for a sale of French casino operator JOA Groupe, four sources familiar with the matter said, adding further to a consolidation wave among European gambling players.

Access Capital Partners has registered Access Capital Fund IX Growth Buy-Out Europe, its latest fund-of-funds vehicle dedicated to investments in European growth and buyout funds, according to a regulatory filing.

Italian buyout house Aksìa Group has soared past its Fund V hard cap to collect more than €275m of new capital. The post Italian PE player Aksìa beats hard cap to raise more than €275m

The $251bn-managing Florida State Board of Administration has made almost $1bn of new commitments across private equity, real estate and distressed debt funds. The post Hefty Summa impact fund, Blackstone Asian RE vehicle among almost

Schroders Capital has bought $1.3bn-managing Dutch real estate fund and asset management firm Cairn Real Estate. The post Schroders Capital completes purchase of $1.3bn-managing Dutch real estate investor Cairn first appeared on AltAssets Private Equity

Descartes Underwriting, an insurance technology company that specialises in climate-based risk, has raised a EUR 120m Series B led by Highland Europe and Eurazeo.

Mergermarket's European private equity editor, Joao Grando, has been appointed the editor of Unquote.

Indico Capital has surpassed the €100m benchmark of assets under management thanks to the closing of the new climate action fund. The post Indico closes first Portugal-focused climate action fund to invest in its blue

Sweden-based technology investor VNV Global has announced its European expansion plans and bolstered its investment team.

France-based private equity house Ardian has closed its second real estate fund on €1.2bn, as it refocuses to ESG assets. The post Ardian closes second real estate fund as it targets Green+ opportunities first appeared

Central European private equity firm Abris Capital Partners has acquired Dentstore, a distributor of dental consumables and equipment. The post Abris Capital picks up third Romanian dental company first appeared on AltAssets Private Equity News.

Private equity giant KKR has led a consotrium in a €1.56bn takeover of Dutch bicycle maker Accell Group. The post KKR leads €1.56bn takeover of Dutch bicycle maker Accell Group first appeared on AltAssets Private

Accell Group, one of Europe's largest bicycle manufacturers, has agreed to a EUR 1.5bn takeover offer from KKR and minority shareholder Teslin.

Germany's TeamViewer attracted take-private interest from financial suitors last year, three sources familiar with the matter have said, underscoring the extent of private equity's raid on European public companies.

Recent Comments