EDDI forum to hold first meeting next month

A temporary forum created by the European Central Bank to discuss the proposed European Distribution of Debt Instruments (EDDI) project will hold its first meeting in September.

A temporary forum created by the European Central Bank to discuss the proposed European Distribution of Debt Instruments (EDDI) project will hold its first meeting in September.

Maturing biotech venture market in Europe drawing more venture capital

Secondaries private equity fund managers have traditionally had a heavy focus on the North America market - but new fundraises are seeing the sector begin to spread its reach, the latest data from Preqin shows.

A temporary forum created by the European Central Bank to discuss the proposed European Distribution of Debt Instruments (EDDI) project will be holding its first meeting next month.

ABN Amro plans to quit corporate banking outside of Europe, except for clearing, and also exit trade and commodity finance in a shake-out of its corporate and investment banking activities.

Italian MPs are threatening to use a vote in parliament this week to derail a recent EU agreement on planned reforms for the European Stability Mechanism (ESM).

Sovereign and corporate debt has rocketed during the coronavirus pandemic, as liquidity became the essential plaster to cover the almost overnight collapse in consumer spending. European treasurers might be tempted to spend 2021 shying away

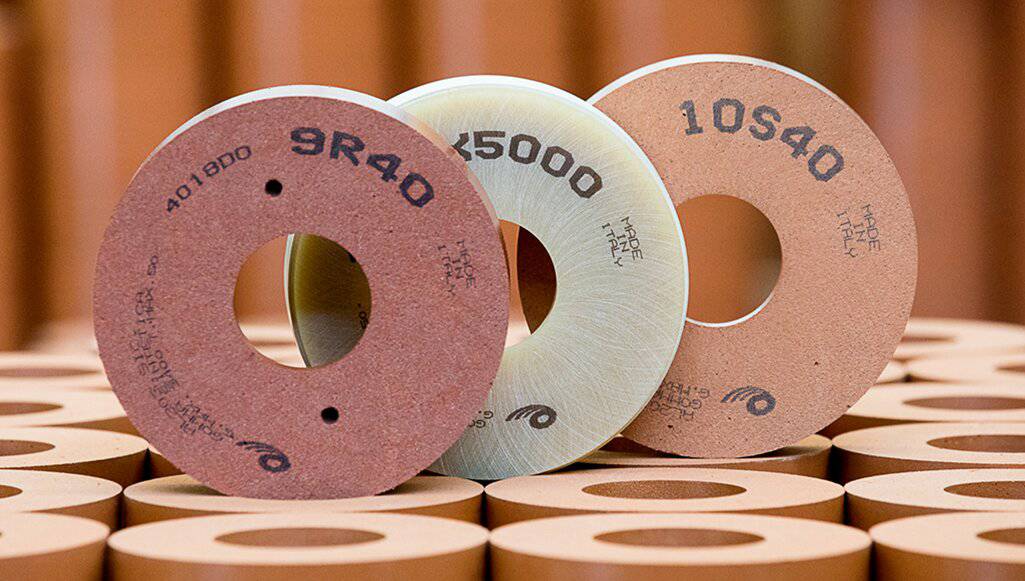

Astorg has agreed to sell its portfolio company Surfaces Group to TA Associates. Surfaces Group is a supplier of abrasive tools and consumables used in the manufacturing process of high-end materials. The group’s products are

Europe's Advent Life Sciences has sealed a sale of KaNDy Therapeutics Ltd to industry giant Bayer in a deal which could see it collect in excess of $975m.

Industry giant Mittal, the Swarovski family and Skype co-founder Niklas Zennström are all among backers of a €50m fund raised by woman-led venture capital firm La Famiglia.

Laxman Pai, Opalesque Asia: European private equity and venture capital entry volume dropped to a five-year low in the first half of 2020 as managers turned away from deal-making to focus on their existing portfolios

Carlyle is reportedly eyeing a potential sale of Portuguese plastic packaging producer Logoplaste which could see the business valued at more than €1bn.

The US-based firm expects to close its debt strategies by the end of the year

Siegfrield Ruhl, the head of funding and investor relations at the European Stability Mechanism, will be seconded to the European Commission later this month as it gears up for its vast borrowing programme.

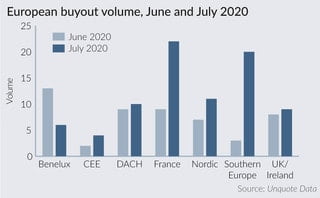

The buyout market is picking up again following one of the worst slumps on record, with some of the regions originally hardest hit becoming busier in July. Mariia Bondarenko reports

Kester Capital has hit the £90m hard cap for the final close of its oversubscribed sophomore fund.

Nordic private equity investor CapMan is in sight of its €85m goal for its latest growth fundraise.

The Republic of Poland, the first European country to issue a Panda bond in August 2016, has finished the documentation process for its second onshore renminbi offering, GlobalCapital China understands.

Dutch private equity house Avedon Capital Partners has picked up at least €500m for its latest buyout fundraise, well above the total raised for its predecessor vehicle.

Chris Robinson joins as a senior investment director

Recent Comments