Endpoint Announces New $40 Million Investment From First American to Expand Digital Real Estate Closing Platform

Companies would have to report on the financial impacts of climate change on their businesses within the next five years

A Biden victory should still herald a big shift in Washington’s approach on climate change - but how far?

Video gaming-focused venture capital house Griffin Gaming Partners has raised $235m to invest across the already titanic industry.

PAI Partners has agreed to acquire Addo Food Group from LDC and Winterbotham Darby from Equistone Partners Europe.

Distressed investment specialist Cerberus Capital Management is reportedly eyeing up to $3bn for its latest flagship fundraise.

European lottery operator Sazka Group has picked up a €500m investment from private equity giant Apollo Global to value the business at about €4.2bn.

SoftBank Vision Fund has led a $250m funding round for Germany-based e-scooter startup Tier Mobility.

TA Associates has brought in Advent International fundraising exec Andrew Harris as its new global investor relations head.

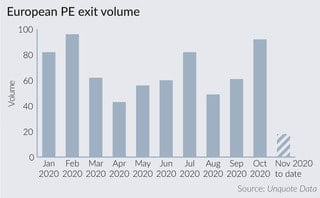

Following another period of lacklustre exit activity in Q3, even as deployment was picking up, October saw a notable spike in divestments by PE players across Europe.

Lower mid-market private equity specialist The Riverside Company has brought in former AlpInvest North America head Iain Leigh in the wake of his retirement from APG Asset Management.

Mid-market Chicago buyout house CIVC Partners has celebrated its 50th year in of investing by sealing a hard cap-beating $525m final close for its sixth flagship fundraise.

Credit and distressed investment specialist Värde Partners has hauled in a target-busting $1.6bn for a new Covid-19 dislocation fund, just a year after raising its biggest-ever flagship buyout fund.

Silver Lake spinout Sumeru Equity Partners has soared past its Fund III goal to haul in $720m for a final close of the investment vehicle.

The company said it anticipates an increased need by UK companies for fresh equity, and that a proactive public and private equity investment strategy can generate positive returns

Coherent, which helps insurers build digital-first services, has scored $14m in its Series A funding round.

The deal is the first European investment of the firm’s Eurazeo Brands division, launched in 2017 to focus on consumer and retail opportunities in the US and Europe

Sustainability-focused private equity and infrastructure investor Zouk Capital has appointed UK House of Lords member Paul Myners to its board.

Private equity major New Mountain Capital has bought healthcare benefits administrator HealthComp from Alpine Investors.

PAI Partners has picked up Addo Food Group and Winterbotham Darby from fellow private equity houses LDC and Equistone respectively.

Recent Comments