TA Associates Grinds Away

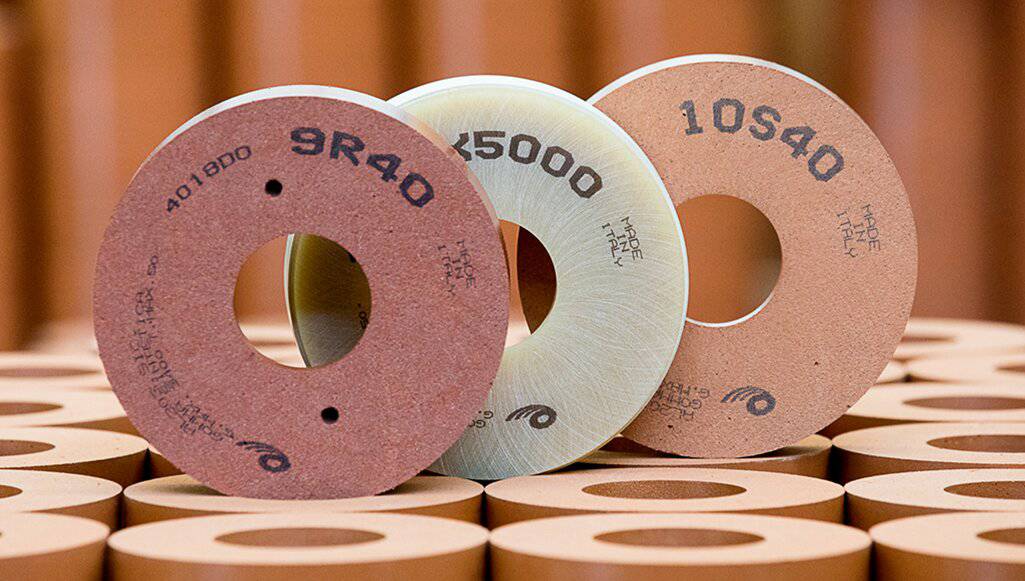

Astorg has agreed to sell its portfolio company Surfaces Group to TA Associates. Surfaces Group is a supplier of abrasive tools and consumables used in the manufacturing process of high-end materials. The group’s products are

Recent Comments