Kester Capital closes second fund on £90m

UK-based SME primary buyout investor Kester Capital has held a final close for Kester Capital II on its hard-cap of £90m.

UK-based SME primary buyout investor Kester Capital has held a final close for Kester Capital II on its hard-cap of £90m.

Siegfrield Ruhl, the head of funding and investor relations at the European Stability Mechanism, will be seconded to the European Commission later this month as it gears up for its vast borrowing programme.

Industry Ventures has hit a $180m final close for its second co-investment fund amid talking up the "compelling opportunity" to invest in digital transformation in the coronavirus pandemic.

Australian theme park and cinema operator Village Roadshow has agreed to a cut-price offer from BGH Capital as it looks to recover from the impact of the coronavirus crisis.

Indian borrowers are finally returning to the offshore loan market after months of little to no action. But even as a pipeline builds, bankers remain wary of challenges around execution. Pan Yue reports.

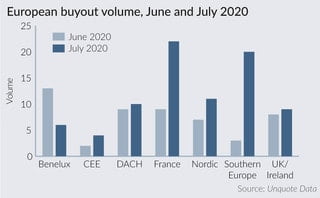

The buyout market is picking up again following one of the worst slumps on record, with some of the regions originally hardest hit becoming busier in July. Mariia Bondarenko reports

Kester Capital has hit the £90m hard cap for the final close of its oversubscribed sophomore fund.

Nordic private equity investor CapMan is in sight of its €85m goal for its latest growth fundraise.

Private equity-backed insurance software company Vertafore is in the sights of other buyout houses and rival Roper Technologies in what could end up as a $5.5bn buyout.

Mining-focused private equity house Tembo Capital is targeting up to $300m for a new fund to follow its stand-out sophomore raise in the sector last year.

Global private equity giant Blackstone is reportedly near a $1.7bn buyout of Indian property developer Prestige Group's rental income assets in what is said to be the largest real estate portfolio buyout in the country

Private equity house Thoma Bravo has upped its previously agreed deal for cloud insurance software provider Majesco to $729m amid rival interest from a new suitor.

The UK Debt Management Office raised £8bn with its first 15 year syndication on Tuesday morning – the first of two Gilt syndications it will hold during September.

Singapore-based special purpose acquisition company (Spac) Aspirational Consumer Lifestyle Corp is looking to raise $225m from a listing on the New York Stock Exchange.

The Republic of Poland, the first European country to issue a Panda bond in August 2016, has finished the documentation process for its second onshore renminbi offering, GlobalCapital China understands.

Posted by Phillip Goldstein, Bulldog Investors, on Saturday, August 8, 2020 Editor's Note: Phillip Goldstein is the co-founder of Bulldog Investors. This post is based on his letter to the SEC Division of Investment Management.

In the week ending August 7th 2020, Bill Ackman's Pershing Square Holdings reported that its portfolio made money in July, boosting his monthly performance to 4.6 percent. Pershing Square Holdings is now up 34.8 percent

PolyVision, a portfolio company of Industrial Opportunity Partners (IOP), has acquired Marsh Industries, a manufacturer of visual display boards. IOP acquired PolyVision in February 2020 from publicly traded Steelcase. Marsh Industries is a maker of

Blackstone has agreed to acquire Ancestry from Silver Lake, GIC, Spectrum, and Permira at an enterprise value of $4.7 billion. The buy of Ancestry is the first control acquisition for Blackstone Capital Partners VIII LP

Australian buyout major Pacific Equity Partners has hit an A$2.5bn hard cap final close for its sixth flagship fundraise.

Recent Comments