Bencis loos to raise $560m for its sixth private equity fund

Bencis, an investment firm focused on the Netherlands, Germany and Belgium, is looking to raise $560m for its sixth fund.

Bencis, an investment firm focused on the Netherlands, Germany and Belgium, is looking to raise $560m for its sixth fund.

Encore Capital Management has pulled in up to $27m for its third housing opportunity fund, AltAssets reports.

In the past several weeks, Jio has raised 115.69bn rupees from leading technology and private equity firms.

Laxman Pai, Opalesque Asia: UK-based private equity firm Bridgepoint Advisers has agreed to buy rival buyout group Swedish-based EQT Partners' €3.9bn ($4.5 billion) credit business. EQT, which has €62 billion in asse...Article Link

Laxman Pai, Opalesque Asia: UK-based private equity firm Bridgepoint Advisers has agreed to buy rival buyout group Swedish-based EQT Partners' €3.9bn ($4.5 billion) credit business. EQT, which has €62 billion in asse...Article Link

Private equity firm HQ Capital has just announced the raise of its largest fund ever in its three decade-long history. The global alternative investment firm of the Germany based HQ Group has announced the final

The group launched company voluntary arrangements in the UK and North America as the high street reels from the pandemic

The Sterling Group has held an oversubscribed and hard cap close of its fifth fund, Sterling Group Partners V LP, with $2 billion of capital. The new fund was raised after just four months of

The fund of funds, which surpassed its target of $600m, is set to invest in Asia, Europe, and the US

Capricorn ICT Arkiv has completed its third successful exit with the sale of genomics data analysis solutions provider BlueBee to Illumina, a fellow life science business.

Providence Equity Partners is to complete a single-asset restructuring deal for HSE24, the operator of German TV channel Home Shopping Europe.

Founded in 1965, Roompot is the number one operator of holiday parks in the Netherlands

Mobeus Equity Partners has led a £4m round for MyTutor, a UK-based platform for interactive one-to-one tuition for secondary-school-aged pupils.

The acquisition of SCAE Europe, an Italian bag-making machinery manufacturer, will help Amutec expand into the British and North American markets

Private equity giant KKR has acquired holiday parks provider in Western Europe Roompot Group, for an undisclosed amount.

The former boss of beleaguered mobile payments and commerce company Mozido has joined private equity firm One Equity Partners as its new operating partner. R. Todd Bradley will take up the role after having served

HLD Europe has announced it is in exclusive negotiations to acquire a majority stake in France-based petrol station and fuelling equipment company TSG.

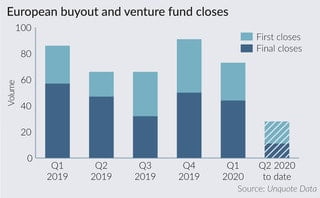

Unquote recorded 44 first or final closes of European private equity funds between March and May, a 42% drop on the three-month average seen across 2019. By Mariia Bondarenko and Greg Gille

Hearst Ventures, which is the venture capital division of media company Hearst, has named two new senior hires.

London-based asset management firm Goodhart Partners is buying out more than 30 minority stakeholders in private equity firm CapitalSpring, according to The Wall Street Journal. Goodhart Partners had previously bought a minority share in the

Recent Comments