JB Chemicals closes acquisition loan with 12 banks

India’s JB Chemicals & Pharmaceuticals has wrapped up a $206m loan to support KKR’s acquisition of a majority stake in the company.

India’s JB Chemicals & Pharmaceuticals has wrapped up a $206m loan to support KKR’s acquisition of a majority stake in the company.

Chinese pork producer Muyuan Foods saw lukewarm appetite among banks for its debut syndicated loan, which was closed at a smaller size of $140m.

Protera, an AI-driven startup designing and developing new proteins, has closed a $5.6m Series A financing led by European life sciences venture capital major Sofinnova Partners.

A cybersecurity company launched by the former head of Israel’s Internal Security Agency Shin Bet has picked up $7m of seed funding led by Jerusalem Venture Partners and private angel investors.

Two sovereigns pulled off successful deals on Wednesday, adding to the pile of syndicated European government bond issuance this week.

Alinda Capital Partners, which is focused on mid-market infrastructure investments, has made the first exit for its Infrastructure Fund III, through the sale of Energy Assets.

Though China has increased co-operation with Central and Eastern European nations in recent years, provoking some concern in the EU, investment volumes remain muted. Non-EU nations in the Balkans, however, offer a chance to progress

Chinese electric vehicle manufacturer Nio hit the US market with a follow-on offering of American Depositary Shares (ADS) on Tuesday.

UPL Corp broke a month-long absence of Indian issuers in the international debt market, raising $500m from investors.

Wing Venture Capital has hit a $450m final close for its biggest fund to date, despite having to raise the fund virtually due to the coronavirus pandemic.

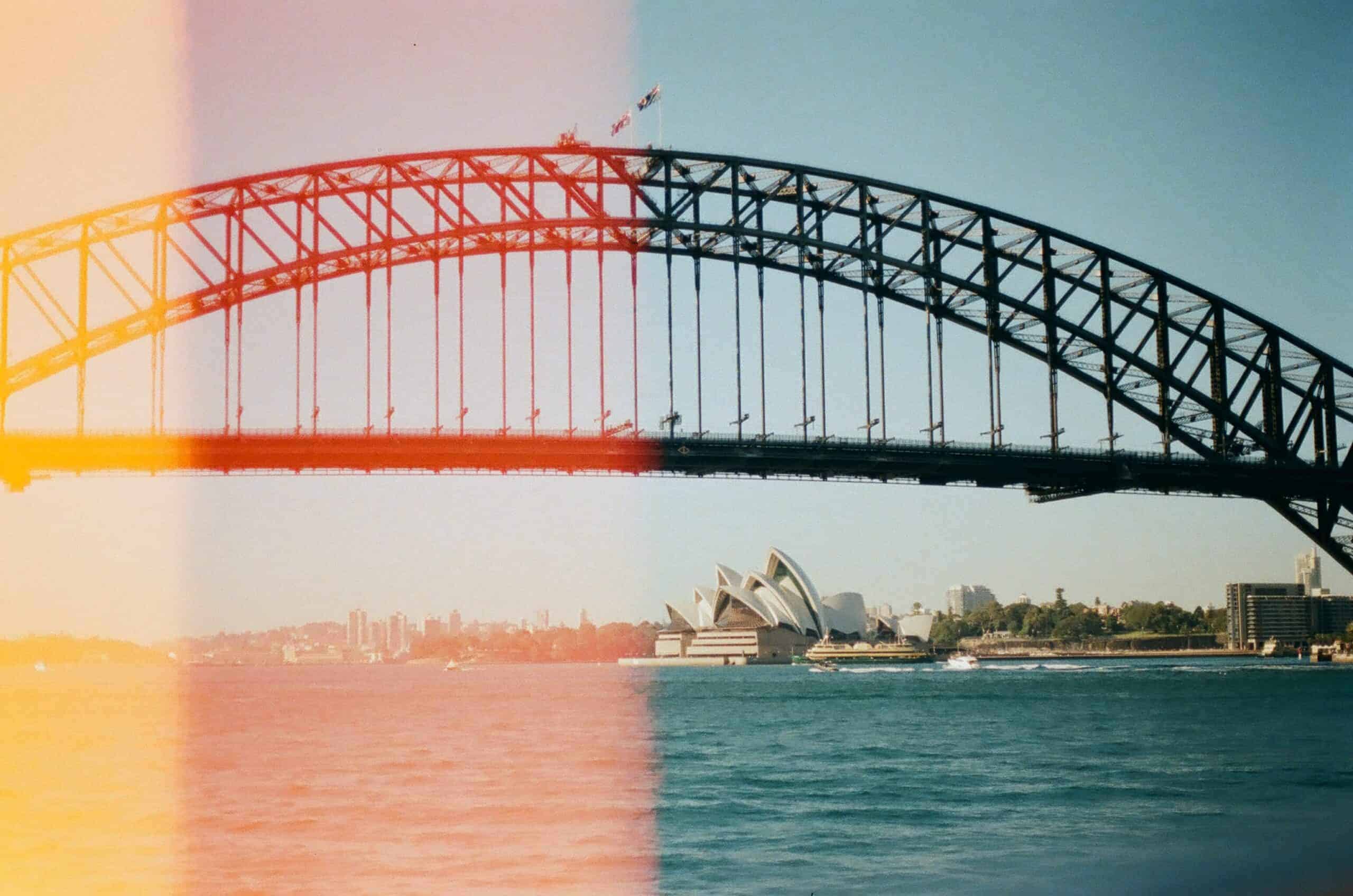

Woori Bank is set to make its Kangaroo bond debut, seeking to tap the Australian dollar market to fund its coronavirus response.

Singapore investment house Vulpes is looking to repeat a barnstorming return made in the wake of the global financial crisis by launching a dedicated coronavirus investment vehicle.

Cathay Capital has raised RMB820m ($120m) for the first close of a new fund it says will help fight climate change in tandem with a pair of green energy investors.

Mason Wells has hauled in $767m for the final close of its biggest ever fund, as it looks to boost its investments across the US Midwest.

Bankrupt and insolvent credit investment specialist Balbec Capital is gearing up for a swathe of dealmaking after beating its target for its latest fundraise through a $1.2bn final close.

Indian conglomerate Reliance Industries has made a quick return to the loan market, raising a $1bn facility to refinance a bond maturing later this month.

The firm, which focuses on the European lower mid-market, has bolstered its investment and investor relations teams

LA-based private equity house Aurora Capital Group has officially collected close to $1.6bn for its sixth flagship fundraise, beating its initial $1.5bn goal.

Financial services digitisation platform Nymbus has picked up $12m in a new financing round led by major shareholders Insight Partners and Vensure Enterprise. Nymbus said the new capital would go towards supporting rapid market penetration for

Recent Comments