IK exits Bahr Modultechnik in EUR 98m trade sale

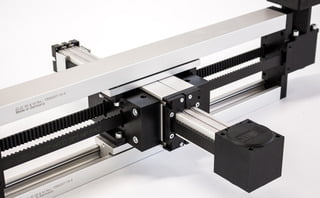

IK Partners is to exit Germany-headquartered modular electric linear motion systems producer Bahr Modultechnik in a EUR 98m trade sale to IMI, a UK-based engineering company.

IK Partners is to exit Germany-headquartered modular electric linear motion systems producer Bahr Modultechnik in a EUR 98m trade sale to IMI, a UK-based engineering company.

US Hispanic market focused Palladium Equity has promoted managing directors Deborah Gallegos and Carlos Reyes to co-heads of ESG and sustainability to succeed Eugenie Cesar-Fabian. The post Palladium promotes Gallegos, Reyes to co-heads of ESG and

As it prepares to launch its NAV-based financing strategy, private debt manager Pemberton is eyeing trends including generational change and market consolidation that could boost demand for its loans. Unquote spoke to Pemberton’s Tom Doyle

Astorg has acquired British medical communications company Open Health from American GP Amulet Capital.

Sun European Partners has acquired Italy-based Tenax, a manufacturer of chemical products and tools for the treatment of materials and stones; the Bombana founding family is reinvesting for a minority stake.

French private equity group Astorg has agreed to acquire pharmaceutical communications provider OPEN Health from healthcare-focused buyout house Amulet Capital Partners. The post Astorg to acquire pharmaceutical communications provider OPEN Health from Amulet first appeared on

Pan European buyout house IK Partners has agreed to exit Small Cap II portfolio Bahr Modultechnik to IMI, valuing it at a €98m enterprise value. The post IK Partners exits Small Cap II portfolio Bahr Modultechnik

Trustar Capital, formerly known as CITIC Capital Partners, is said to be eyeing $3.5bn for its fifth China buyout fund. The post Trustar Capital eyes mammoth $3.5bn China buyout fund – report first appeared on

Global buyout major Advent International has set up a joint venture with specialty chemicals company LANXESS to carve out DSM Engineering Materials at €3.7bn enterprise value. The post Advent sets up JV with LANXESS to

Integral Venture Partners-led consortium has agreed to acquire deep-tech enterprise software provider Ontotext. The post Integral Venture Partners leads a consortium for Ontotext buyout first appeared on AltAssets Private Equity News.

Central European industrials-focused GP Jet Investment is doubling down on its industrial impact strategy and assessing opportunities in the region as it heads for its next fundraise, partner Marek Malik told Unquote.

Private equity firm Livingbridge has hired PwC to explore a sale of its British home care business Helping Hands, according to two sources familiar with the situation.

Zurich-based venture capital investor Redalpine has hired entrepreneur Oliver Pabst as general partner following fund launch. The post Venture capital firm Redalpine hires Oliver Pabst as partner following $1bn fund launch first appeared on AltAssets

Bain Capital has agreed to acquire 55% stake in House of HR. House of HR Management, Naxicap and founder Conny Vandendriessche will hold the remaining equity. The post Bain Capital to buy 55% stake in

Blackstone has hired Mark Glengarry from Anchorage Capital Group as head of Asia Pacific origination, Blackstone Credit (BXC). The post Blackstone hires Mark Glengarry to expand credit business in Asia first appeared on AltAssets Private

Financial services and healthcare-focused private equity house Flexpoint Ford has hired Meredith Stein as head of investor relations. The post FlexPoint Ford brings in IR veteran Stein as head of investor relations first appeared on AltAssets

Northern European private equity firm FSN Capital Partners has acquired Epista Life Sciences, a Danish IT consultancy for the life sciences sector.

TDR Capital and Mohsin and Zuber Issa – the founders and co-CEOs of petrol station forecourt retailer business EG Group – are considering to walk away from its proposed Boots buyout after being asked to

Gallant Capital, an LA private equity firm formed by a pair of former Gores Group execs, is reportedly back fundraising eyeing up to $600m for its sophomore fund. The post Gallant Capital said to seek

Advent Life Sciences, a European venture and growth investor, has hired three partners as the sector continues to attract increasing investor attention.

Recent Comments