Epiris buys Sepura in EUR 159m carve-out deal

Epiris has acquired Sepura, a UK-based provider of digital walkie-talkies for public safety users, from Hytera Communications, a Chinese manufacturer of wireless telecommunication equipment.

Epiris has acquired Sepura, a UK-based provider of digital walkie-talkies for public safety users, from Hytera Communications, a Chinese manufacturer of wireless telecommunication equipment.

FPE Capital, a software and services focused lower mid-market growth investor, has invested in Dynamic Planner, a software provider to the UK wealth management sector, according to a statement.

Border to Coast Pensions Partnership has chosen StepStone, General Catalyst and PAI Partners for its latest private equity investments, allocating $100m each to their funds. The post Border to Coast commits $100m each to StepStone,

Private equity major Permira has reportedly raised more than €16bn for its new flagship buyout fund, beating its target at first close. The post Permira said to hit €16bn for massive new fundraise, still collecting

Bridgepoint has appointed Macquarie to oversee its exit of Cambridge Education Group's (CEG) private equity backer, a UK-based pathway programme provider, five sources familiar with the situation said.

The $204bn-managing Texas Teachers' Retirement System has backed a string of new private equity and real estate funds managed by firms including Blackstone and EQT. The post Blackstone, EQT megafunds among latest Texas Teachers’ commitments

UK private equity investor Pelican Capital is celebrating a roughly 6.5x return through the exit of parking technology provider YourParkingSpace. The post Pelican Capital scores 6.5x return through savvy YourParkingSpace investment first appeared on AltAssets

Submissions for the 2022 Unquote British Private Equity Awards are now open until 29 July at 5pm.

UK-focused sponsor August Equity will look to raise its sixth fund towards the end of the year with a target of around GBP 400m, a source familiar with the situation told Unquote.

Hg has appointed Moelis to sell Commify, a UK-based business communications services group, three sources familiar with the situation said.

Submit your entry for the 2022 Unquote British Private Equity Awards before 15 July 2022 at 5pm

Perwyn, a UK-based family-backed private and growth equity investor, has appointed James Gavey as its new CFO.

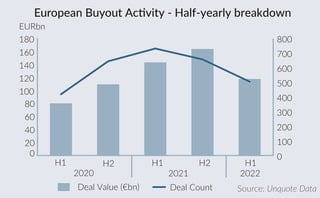

Following an almost too-good-to-be-true year in 2021, the outbreak of war in Ukraine and an impending recession are bringing a dose of realism to the world of private equity.

Private equity firm Waterland has invested in Cooper Parry in a deal that will transform the UK tax and audit advisor from an LLP to a limited company.

Gresham House Ventures has sold its majority stake in Media Business Insight (MBI), a UK-based content, insight, and events company for the creative media industry, in an off-market transaction to GlobalData, an AIM-listed data and

HIG Capital’s distressed debt and special situations arm, HIG Bayside, has promoted Mathilde Malezieux to managing director. The post HIG promotes debt specialist Malezieux to managing director in Bayside arm first appeared on AltAssets Private

Russia’s invasion of Ukraine, surging energy prices and supply chain disruption combined to create an exceptionally challenging environment for dealmakers in Q1 2022, the latest Clearwater Multiples Heatmap shows.

Mid-market sponsor Inflexion has agreed to sell Global Reach Group, a UK-based foreign exchange specialist, to Fleetcor Technologies, a US-listed business payments company.

Apollo Global Management is said to have teamed up with Mukesh Ambani's Reliance Industries to make a binding bid for UK chemist chain Boots, which values the company at £5bn to £6bn. The post Apollo,

US private equity house Lovell Minnick Partners has agreed to buy a majority stake in $4.1bn-managing wealth and asset manager London & Capital. The post Lovell Minnick picks up majority stake in veteran wealth, asset

Recent Comments