Mid-sized UK companies see rise in investment from private equity but have growth concerns

Private equity has delivered resilience and resources to help mid-tier businesses during the pandemic

Private equity has delivered resilience and resources to help mid-tier businesses during the pandemic

Lower mid-market focused private equity house Lonsdale Capital Partners scored a 2.5x return by selling London-based mortgage broker Charles Cameron & Associates to Penta Capital backed Socium Group. The post Lonsdale sealed 2.5x return exiting

The board of Sanne, a UK-based provider of alternative fund and corporate administration services, is in advanced discussions with Apex, a Bermuda-based fund administration company, regarding a potential 920p-per-share offer for the business.

Lonsdale Capital Partners has sold UK-based mortgage broker Charles Cameron & Associates (CC&A) to Socium Group after two years of ownership.

Mayfair Equity Partners has backed the management buyout of Tangle Teezer, a UK haircare brand.

Livingbridge has acquired UK-based IT service business North from Aliter Capital, which formed the business via a buy-and-build strategy that began with its acquisition of Boston Networks in 2018.

MANCHESTER, England--(BUSINESS WIRE)-- Relentless today announces a joint venture with KKR to deliver the St Michael’s development in central Manchester. Initial work on the site is expected towards the end of the year in the

Clearlake Capital has agreed to buy Springs Window Fashions from AEA Investors and British Columbia Investment Management Corporation. The post Spring Windows gets another new private equity owner as AEA, BCIM agree exit first appeared

Laxman Pai, Opalesque Asia: British hedge fund manager Man Group posted a record record-high funds under management (FUM) during the first six months of 2021, predominately driven by a "strong investment performance...Article Link

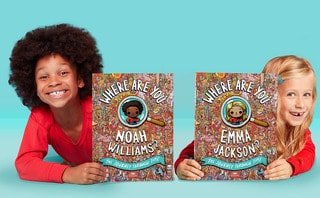

Graphite Capital has acquired UK-headquartered personalised children's books publishing platform Wonderbly.

After Brexit, investors think UK assets can be found cheaply

Britain’s SMEs have been thrown off course by the coronavirus crisis. Here, Bill Nixon explains how his Glasgow-based Maven Capital is enabling them to get back on track.

Sun Capital Partners has acquired Environmental Infrastructure Solutions (EIS), a provider of environmental abatement services, from O2 Investment Partners. O2 formed EIS in October 2019 to house its investments in environmental abatement services companies 1

Buyout giant KKR is reportedly the latest investor in talks with World Rugby for a potential investment in the commercial rights of its global competition. The post KKR said to enter scrum for rugby union

Palamon Capital Partners has scored what looks to be an impressive return selling online beauty products seller Feelunique to trade buyer Sephora. The post Palamon picks up impressive return selling beauty products seller Feelunique first

Apax Partners has continued its strong fundraising year through a target-busting €1.6bn final close of its tenth mid-market investment vehicle. The post Apax Partners continues busy 2021 fundraising activity with €1.6bn close of tenth mid-market

It is the latest in a series of moves by the watchdog to establish how it plans to adapt its approach to regulating the UK since the country’s split from the European trading bloc.

It is the latest in a series of moves by the watchdog to establish how it plans to adapt its approach to regulating the UK since the country’s split from the European trading bloc.

XL Marketing, a digital and direct marketing company, today announced an investment by private equity firm GCP Capital Partners as well as a debt facility agented by Madison Capital Funding. The $70 million capital raise

Recent Comments