Kester Capital hits hard cap close for sophomore private equity fundraise

Kester Capital has hit the £90m hard cap for the final close of its oversubscribed sophomore fund.

Kester Capital has hit the £90m hard cap for the final close of its oversubscribed sophomore fund.

Mining-focused private equity house Tembo Capital is targeting up to $300m for a new fund to follow its stand-out sophomore raise in the sector last year.

The UK Debt Management Office raised £8bn with its first 15 year syndication on Tuesday morning – the first of two Gilt syndications it will hold during September.

Posted by Phillip Goldstein, Bulldog Investors, on Saturday, August 8, 2020 Editor's Note: Phillip Goldstein is the co-founder of Bulldog Investors. This post is based on his letter to the SEC Division of Investment Management.

In the week ending August 7th 2020, Bill Ackman's Pershing Square Holdings reported that its portfolio made money in July, boosting his monthly performance to 4.6 percent. Pershing Square Holdings is now up 34.8 percent

Private equity firms remain bullish on their portfolio investments despite the widespread chaos caused by the coronavirus crisis, new research suggests.

Global investment giant Aberdeen Standard Investments has boosted its private equity capabilities by bringing in former Cinven exec Chris Robinson for its European operation.

Ukraine-based private equity firm Horizon Capital is in the process of selling, alongside other shareholders, its stake in Moldova-based Glass Container Company and Glass Container Prim to Vetropack Austria Holding.

Marcol has acquired a 90% stake in Germany-based telemedicine startup Fernarzt and has announced the launch of its UK-headquartered digital health business HealthHero.

Visma, a PE-backed Norwegian cloud software company, has acquired Rotterdam-based accounting software company Yuki.

YFM Equity Partners portfolio company DSP has acquired Oracle software consultancy Explorer UK.

The restaurant chain, which has been struggling since the pandemic hit, is putting itself up for sale and is looking to close some 67 restaurants in the UK

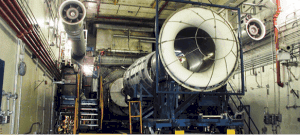

After just over a five-year hold, Gen Cap America has sold Aero Systems Engineering to Calspan Technology. Aero Systems Engineering (ASE) designs, builds and upgrades jet engine testing and wind tunnel facilities, and provides lab

The deal will support the expansion of the British company's offering and customer base, both organically and through acquisitions

Struggling private equity-backed restaurant group Pizza Express is set to be largely taken over by bondholders as the business reels under the strain of the coronavirus lockdown.

Debt-heavy UK roadside recovery business AA could be coming back into private equity hands after receiving buyout interest from a string of big-name firms.

UK private equity house Growth Capital Partners has made its tenth investment from its £205m fourth fund by picking up adhesives, laminates and insulation materials maker GTS.

UK private equity house Epiris has swooped to buy restaurant chains Bella Italia, Café Rouge and Las Iguanas in a bid to rescue the eateries following their long closures due the coronavirus crisis.

The deal comprises 140 restaurants under the Bella Italia, Café Rouge and Las Iguanas brands and is expected to save 4,000 jobs out of the nearly 6,000 staff the company had in the UK

A new venture capital fund targeting the commercialisation of projects and spinouts from academics at University College London has hit a £100m first close.

Recent Comments