Tikehau partially realises EuroGroup Laminations stake in Milan IPO

France-headquartered sponsor Tikehau Capital has agreed to list Italian steel components producer EuroGroup Laminations on the EuroNext Milan.

France-headquartered sponsor Tikehau Capital has agreed to list Italian steel components producer EuroGroup Laminations on the EuroNext Milan.

Euro Group Laminations, an Italian producer of steel components for electric motors, could kickstart an IPO process in the coming weeks, three sources said, adding that a board vote to launch the listing is imminent.

Blue Owl Capital, a New York-based alternative asset manager, is keen to resume preparation for an IPO of Dyal Capital Partners in the second half of this year, sources with knowledge of the situation said.

Investors that participated in the latest placement into the electric vehicle (EV) charging solutions business owned by Swiss industrial company ABB could take anchor or cornerstone roles at the time of the IPO next year,

Private equity majors Nordic Capital and CVC have completed their buyout and delisting of European vehicle glass repair and replacement business Cary Group, just a year after its IPO. The post Just a year after

KnowBe4, a major provider of security awareness training and a simulated phishing platform, has agreed to be bought by Vista Equity Partners in a $4.6bn deal. The post Vista agrees $4.6bn buyout of KKR-backed cybersecurity

Mindful Capital Partners is leaning towards an IPO over a sale of portfolio company Italcer as it progresses through a dual-track process, three sources familiar with the situation said.

Nordic investor Northzone has raised more than €1bn for its biggest fund ever, doubling the size of its 2019 predecessor vehicle. The vehicle – one of the biggest venture capital funds raised in Europe this

Posted by Gregory Pryor and Germaine Gurr, White & Case LLP, on Tuesday, September 6, 2022 Editor's Note: Gregory Pryor and Germaine Gurr are partners at White & Case LLP. This post is based on

US and Asia-focused early-stage investor Cherubic Ventures has scored a big boost to its assets under management with the $110m close of its Fund V vehicle. The post Big IPO wins, PayPal’s $2.7bn Paidy buy

Aurelius has sold the operating company of cosmetic surgery group Transform Hospital Group (THG) to Y1 Capital.

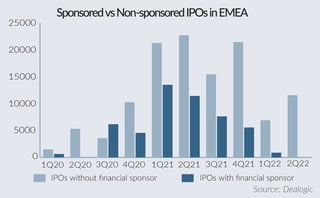

Despite a wave of IPO postponements in 2022, corporate sellers are adjusting to new valuation benchmarks and will be the most likely to pursue IPOs for their assets this year.

European private equity giant CVC Capital Partners has pushed back a planned $20bn-targetting June stock market listing due to market turmoil. The post CVC said to postpone $20bn-targeting stock market listing due to market uncertainty

Danish biotech investor Novo Ventures is set for steady deployment this year as it expects companies across the market to raise larger funding rounds in lieu of public listings, senior partner Naveed Siddiqi told Unquote.

The backer of WeTransfer could revisit exit plans later this year as choppy market conditions favour the chances of a potential private sale versus an IPO, sources familiar with the company said.

CVC Capital Partners’ reported preference for Amsterdam as a potential home for its shares shows that London’s regulatory regime still needs to be far more flexible, several sources said.

India's edtech giant Byju's has closed a $800m pre-IPO funding round at a valuation of $22bn, the Economic Times reported. The post Edtech giant Byju’s said to reach $22bn valuation with latest funding round first

Bogazici Ventures, a Turkey-based venture capital firm, is planning to launch three pre-IPO funds to invest in biotech, gaming and fintech startups, executive board member Baris Ozistek told Unquote.

Golden Goose, an Italian fashion house controlled by private equity group Permira, has started early work on a potential IPO, several sources familiar with the situation said.

Private equity firms Carlyle and Investindustrial are aiming to float portfolio company Design Holdings around the middle of this year, according to several sources familiar with the matter.

Recent Comments