Inflexion reveals trio of new partners amid string of promotions

UK private equity house Inflexion has named three new partners as it continues to build its 100-strong team.

UK private equity house Inflexion has named three new partners as it continues to build its 100-strong team.

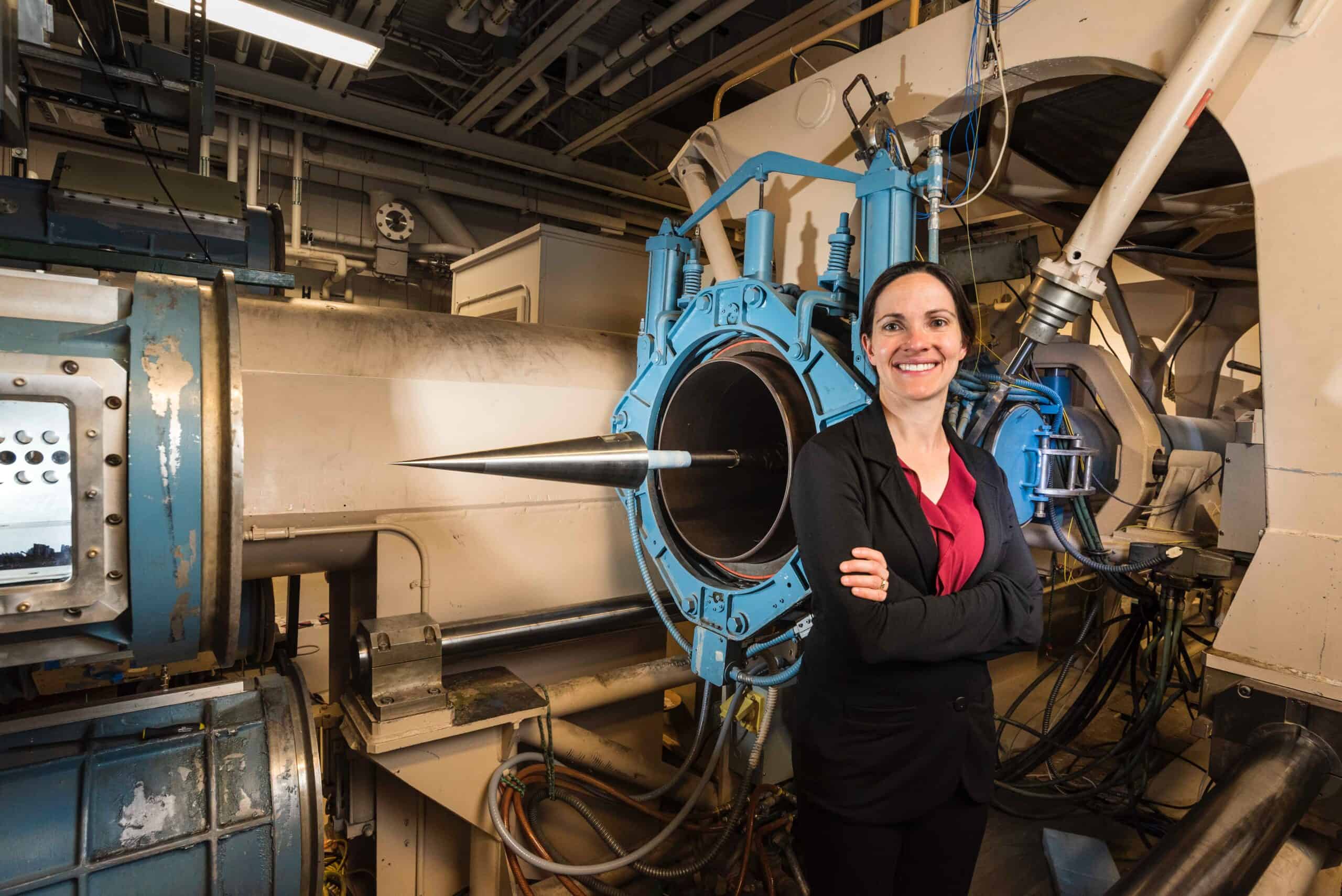

Sustainability-focused European asset management specialist Ambienta has named former Bridgepoint exec Gwenaelle Le Ho Daguzan as its first female partner.

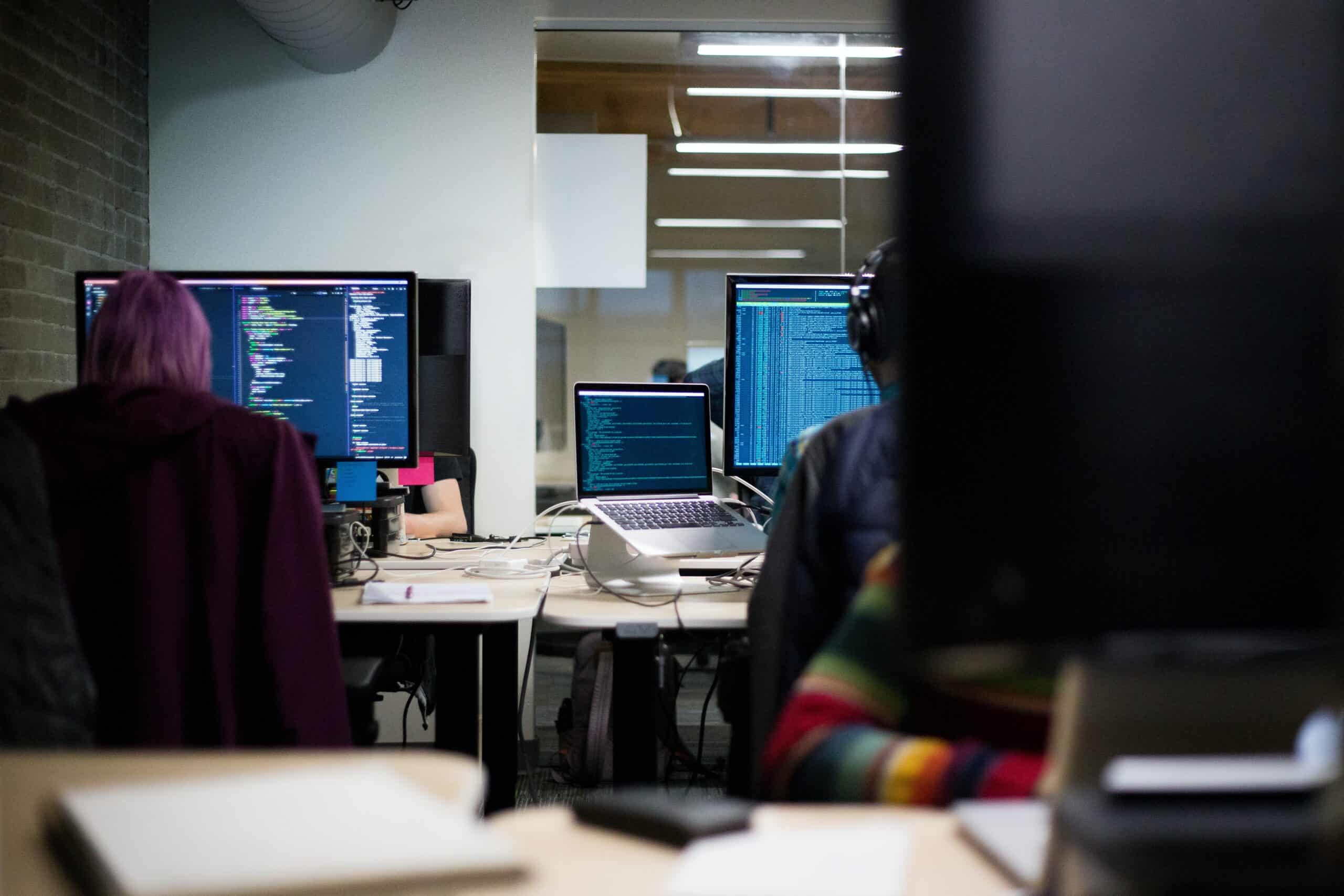

Lloyds Bank private equity arm LDC has invested more than £17m into Beekman Associates, the developer of data-driven marketing procurement platform RightSpend.

Alternative investment major Investcorp has backed Chinese AI-controlled city and smart services developer Terminus Technologies.

Tech-focused private equity giant Silver Lake is reportedly in talks for a $1bn investment in the retail arm of India's Reliance Industries.

BlackRock-backed online retailer The Hut Group (THG) has confirmed its intention to proceed with an initial public offering to raise gross proceeds of around £920m.

Munich Private Equity Partners has made a rapid return to fundraising for a new flagship fund of funds, just a couple of months after wrapping up its predecessor vehicle.

I Squared Capital has completed the $158.5m sale of Peruvian power infrastructure players Etenorte and Eteselva to trade buyer ISA Peru.

BFG Partners, a venture capital firm specializing in early-stage food, beverage and consumer products, has sold Birch Benders to Sovos Brands, a food company backed by private equity firm Advent International.

Point-of-sale financing provider LendingUSA has closed a new credit facility and received a total financing package of up to $200m from Atalaya Capital Management.

European asset manager Amundi deputy CEO Dominique Carrel-Billiard has taken over the operational management of its real and alternative assets business line.

Canadian pension major CDPQ and supply chain specialist DP World have expanded their ports and terminals investment platform to $8.2bn through a new investment.

Private equity giant Blackstone is reportedly leading a buyout consortium alongside Global Infrastructure Partners to buy $18bn-valued US railroad operator Kansas City Southern.

Webster Equity Partners is reportedly eyeing up to $1bn for healthcare investments through the raise of its debut fund solely dedicated to the sector.

Asia-focused alternative asset manager PAG has reportedly hit a $1.5bn final close for its fourth loan fund, just two years after closing its predecessor fund in the strategy.

Providence Strategic Growth has backed Semarchy, a provider of data management software.

Growth equity major TCV has bought a majority stake in spend management tech business Oversight from Luminate Capital Partners.

Global private equity major KKR has sealed the $4.7bn sale of enterprise resource planning software provider Epicor to fellow buyout house Clayton Dubilier & Rice.

Apollo Global has led a $5.5bn real estate deal with the Abu Dhabi National Oil Company which will see the investor group lease some of the group's properties on a long-term basis.

Graycliff Partners has made the debut deal from its $350m fourth fund by picking up wire mesh maker Gerard Daniel Worldwide.

Recent Comments