Eltropy Raises $25 Million in Series A Funding to Expand Digital Communications Platform for Financial Institutions

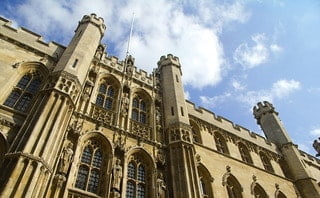

Twelve UK universities have joined forces to create an impact investment fund, Impact 12, to support mission-led university ventures.

Providence, I Squared Capital and CVC Partners are among a select pool of suitors admitted to the second round of bidding for Marlink, according to four sources familiar with the matter.

UK company initially seeks to make certain liver transplants more successful

After three years of significant growth with Fulcrum Equity Partners, SaaSOptics exits to Battery Ventures.(PRWeb June 10, 2021)Read the full story at https://www.prweb.com/releases/fulcrum_equity_partners_successfully_exits_saasoptics_to_battery_ventures/prweb17942764.htm

Posted by Cynthia Hess, Mark Leahy and Khang Tran, Fenwick & West LLP, on Wednesday, June 2, 2021 Editor's Note: Cynthia Hess and Mark Leahy are partners and Khang Tran is an attorney at Fenwick

Posted by Matthew Salerno, Mark McDonald, and Jim Langston, Cleary Gottlieb Steen & Hamilton LLP, on Thursday, May 27, 2021 Editor's Note: Matthew Salerno, Mark McDonald, and James Langston are partners at Cleary Gottlieb Steen

Startup and emerging growth companies can apply to compete by June 3, 2021(PRWeb May 26, 2021)Read the full story at https://www.prweb.com/releases/invest_southwest_announces_2021_venture_madness_event_opens_competition_to_companies_nationwide/prweb17967963.htm

Posted by Jennifer F. Fitchen and Brent M. Steele, Sidley Austin LLP, on Tuesday, March 30, 2021 Editor's Note: Jennifer F. Fitchen and Brent M. Steele are partners at Sidley Austin LLP. Related research from

VC fund investors not raising alarms over SPAC trend From Axios: Venture capital firms, formed to invest in startups, are increasingly becoming sponsors of SPACs, blank-check companies that bring later-stage businesses into the public markets.

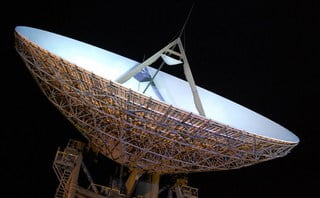

Vance Street Capital has formed Spectra A&D Holdings to acquire and merge three aerospace and defense technology companies. The three acquired businesses include Las Cruces, New Mexico-based Calculex; and Alpharetta, Georgia-based Argon Corporation and FDS

Probo Medical, a portfolio company of Varsity Healthcare Partners since October 2018, has acquired IMAX Medical. IMAX specializes in the sale, purchase, inspection, installation/de-installation, and transport of pre-owned medical diagnostic imaging equipment including ultrasound, X-Ray,

Prelude Growth Partners, an investor in consumer brands, has closed Prelude Growth Partners II LP at its hard cap of $250 million. The firm’s second fund was oversubscribed and was raised in just four months.

Venture funds, which invest in startups that are in early to late stages of development, can lead to higher returns — but of course with more risk.

Esports-focused venture capital firm Hiro Capital has invested €15m in video game studios Snowprint, Double Loop Games and Happy Volcano, based in Stockholm, San Fransisco and Leuven, Belgium, respectively.

Italian venture capital house P101 has invested €6m in a series-B financing round for Madrid-based car rental platform Bipi Mobility.

Memmo.me, a Swedish platform that allows users to request personalised video messages from celebrities, has raised €8.2m in a series-A funding round led by New York-based Left Lane Capital.

Early stage investment giant Bessemer Venture Partners has scored another huge flagship fundraise, hauling in $3.3bn across Fund XI and a new growth-stage vehicle.

New York City startup scene-focused Primary Venture Partners has pulled in $200m of fresh capital through a pair of fundraises.

Lightbank, the venture capital firm co-founded by Groupon billionaire Eric Lefkofsky, has doubled its assets under management through a $180m final close of its second fund.

Recent Comments