Cryosa Closes $21.5 Million Series B Funding Round to Advance Minimally Invasive Obstructive Sleep Apnea Treatment

Laxman Pai, Opalesque Asia: Dallas-based property investor Crow Holdings has raised $2.6bn for its ninth US value-add real estate fund. The real estate investment titan said the Crow Holdings Realty Partners IX fund, ...Article Link

The funding team of the European Stability Mechanism has launched its first physical roadshow to meet investors in person for 18 months, making the supranational agency one of the first, if not the first, to

Posted by Mark Adams, Joy Tan, and Emily Taylor, Russell Reynolds Associates, on Wednesday, September 22, 2021 Editor's Note: Mark Adams co-leads Russell Reynolds Associates’ Private Equity practice; Joy Tan is a member of Russell

Angel Investment Network has announced the launch of its institutional investment arm, AIV Capital, which will focus on private equity and venture capital.

A spectacular fundraising year for Commonfund Capital continues after the firm struck a $675m final close for its new secondaries fund. The post Commonfund’s 2021 fundraising streak continues with new $675m secondaries vehicle first appeared

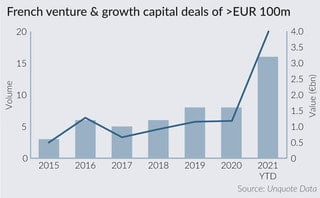

Recent mega-rounds for Sorare, Mirakl and Vestiaire Collective have added to an already rich year for French venture, according to Unquote Data.

With some $715bn in capital designated to impact investments, healthcare represents the third-largest impact category behind financial services and climate change

Specialist investor Blue Bear has closed its second venture capital fund on its $150m hard cap. AIMS Imprint of Goldman Sachs Asset Management, Rockefeller Brothers Fund, ZOMA Capital and McKnight Foundation took part in the

Mirakl provides cloud-based software that helps companies across industries launch and scale online marketplaces

Recent Comments