VERO Announces $5 Million Series A Funding Round Led By Eleven Capital And Bienville Capital

B. G., Opalesque Geneva: Matt Breidert, senior portfolio manager and managing director of Listed Sustainable Infrastructure & Energy Transition at TortoiseEcofin, talks to Opalesque about the influence of the new U.S...Article Link

B. G., Opalesque Geneva: Matt Breidert, senior portfolio manager and managing director of Listed Sustainable Infrastructure & Energy Transition at TortoiseEcofin, talks to Opalesque about the influence of the new U.S...Article Link

Unifrax, a portfolio company of Clearlake Capital, has agreed to acquire publicly traded Lydall at an enterprise value of approximately $1.3 billion. Clearlake acquired Unifrax from American Securities in October 2018. Lydall (NYSE: LDL) designs

Platinum Equity has agreed to acquire a majority stake in SVP-Singer Holdings (“SVP Worldwide”), the world’s largest consumer sewing machine company. Singer was formed in 1851 by Isaac Singer and Edward Clark. The company began

Middle-market investor GI Partners has held an oversubscribed and above target closing of GI Partners Fund VI LP with $3.9 billion in total commitments. The firm’s earlier fund closed at its hard cap in November

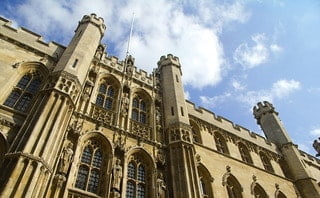

Twelve UK universities have joined forces to create an impact investment fund, Impact 12, to support mission-led university ventures.

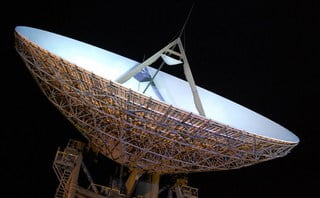

Providence, I Squared Capital and CVC Partners are among a select pool of suitors admitted to the second round of bidding for Marlink, according to four sources familiar with the matter.

UK company initially seeks to make certain liver transplants more successful

Data and transparency will be central if private equity is to meet investors’ concerns about sustainability

Enhanced PE-focused SaaS platform available now for sponsors eager to pursue new deals, achieve operational excellence, accelerate value creation and demonstrate impact(PRWeb June 15, 2021)Read the full story at https://www.prweb.com/releases/maestro_the_private_equity_industrys_collaboration_and_insights_platform_unveils_new_and_expanded_features_amid_todays_frenzied_deal_making_environment/prweb18003297.htm

After three years of significant growth with Fulcrum Equity Partners, SaaSOptics exits to Battery Ventures.(PRWeb June 10, 2021)Read the full story at https://www.prweb.com/releases/fulcrum_equity_partners_successfully_exits_saasoptics_to_battery_ventures/prweb17942764.htm

Gemdale Corp reopened the bond market for high yield Chinese property companies on Thursday with a $480m green deal that landed at fairly 'aggressive' levels.

Philippine property developers Megaworld Corp and Robinsons Land Corp have got approvals from the country’s regulator to float real estate investment trusts (Reits).

Posted by Cynthia Hess, Mark Leahy and Khang Tran, Fenwick & West LLP, on Wednesday, June 2, 2021 Editor's Note: Cynthia Hess and Mark Leahy are partners and Khang Tran is an attorney at Fenwick

Posted by Matthew Salerno, Mark McDonald, and Jim Langston, Cleary Gottlieb Steen & Hamilton LLP, on Thursday, May 27, 2021 Editor's Note: Matthew Salerno, Mark McDonald, and James Langston are partners at Cleary Gottlieb Steen

Posted by Emily Johnston-Ross (FDIC), Song Ma (Yale University), and Manju Puri (Duke University), on Wednesday, May 26, 2021 Editor's Note: Emily Johnston Ross is a Senior Financial Economist at the FDIC Center for Financial

Recent Comments