Healthcare-focused Heal Capital reaches €100m goal for debut fundraise

Healthcare focused venture firm Heal Capital has hit a €100m final close for its debut fundraise.

Healthcare focused venture firm Heal Capital has hit a €100m final close for its debut fundraise.

Slovakian private equity house Sandberg Capital has struck a €109m final close for its second fund.

Partners in Equity has led a €25m funding round for digital health startup Quin.

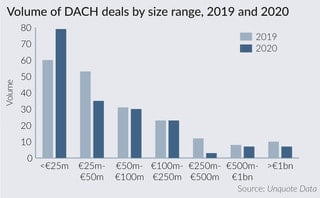

Small-cap dealflow remained fairly stable in the DACH region in 2020, despite the coronavirus crisis. Harriet Matthews reports on the drivers and opportunities in the segment

Secondaries private equity specialist BEX Capital has kicked off the new year by establishing itself in the US, announcing promotions and expanding its team.

Asia-Pacific venture capital investors are steering clear of high-value deals in favour of seed and small Series A rounds amid huge uncertainty in the market, new research shows.

So far, the fiscal and monetary support from governments and central banks in Europe has kept distressed activity depressed

Claret Capital has struck an initial close for its first fund since spinning out of Harbert Management last year.

Laxman Pai, Opalesque Asia: With an overall value of $ 2.9 trillion, global M&A in 2020 is tracking below 2019's value of $3.3tn but still ranks fifth for the value of deals in the post-global

The London-based ESG boutique has hired Sean Maguire, from Norwegian energy producer Statkraft as its managing director

Lower mid-market private equity specialist The Riverside Company has bought landscaping, property services and snow management pair Clintar and TruNet.

Global buyout giant Blackstone has scored more than $3.1bn of LP capital for its debut fund dedicated to growth capital investing.

Healthtech-focused venture capital firm Heal Capital has held a final close for its debut fund on €100m.

Asian private equity house Navis Capital Partners has completed an investment in digital banking solutions business Moneythor.

Sustainable investment specialist Impax Asset Management has bolstered its private equity and infrastructure operations by bringing in Sean Maguire as a managing director.

Recent Comments