Sonrai Security Announces $20M in Series B Funding to Accelerate R&D and Expand Global Reach of Multicloud Identity and Data Governance Platform

by Perrine Dutronc, Sustainable Investing Specialist, Groupe La Française There is no common definition of "sustainable finance", which leaves ample room for interpretation when referencing sustainable investments. Sustainable investm...Article Link

Laxman Pai, Opalesque Asia: The percentage of institutional investors incorporating environmental, social, and governance (ESG) factors continues to grow globally, but so does the divergence between U.S. investors and th...Article Link

by Perrine Dutronc, Sustainable Investing Specialist, Groupe La Française There is no common definition of "sustainable finance", which leaves ample room for interpretation when referencing sustainable invest...Article Link

Finnish food delivery platform Wolt has raised €7.5m in funding from angel investor Lukasz Gadowski.

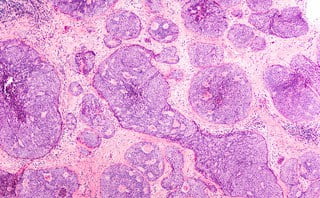

Novartis Venture Fund and Novo Holdings have co-led a €9m series-A funding round for Finnish developer of anti-cancer drugs Rappta Therapeutics.

Unquote rounds up the most notable fundraises currently ongoing in the UK and Irish markets across the buyout, venture and secondaries spaces, with the latest available intel for each vehicle.

CVC Capital Partners, Advent International and FSI have won exclusivity in the negotiations for Italian football league Serie A.

Veteran venture capital firm Canaan Partners has scored another $800m fund close to wrap up capital raising for its 12 early-stage investment fund targeting healthcare and technology companies.

US venture capital exit activity has hit its second-highest value ever recorded despite global volatility in recent months due to the coronavirus crisis, new research shows.

UK private equity house Felix Capital has brought in former Facebook exec Angela Chou and Vitruvian Partners' Joseph Pizzolato as its latest investment professionals.

Global private equity giants CVC Capital Partners and Apollo Global are reportedly leading the race to grab a stake in the lucrative broadcasting rights of Italy's top football league.

Nuveen, the $1tn global investment manager of insurance giant TIAA, has led a Series B growth equity round in Advanced Battery Concepts.

Felix Capital has hired Angela Chou and Joseph Pizzolato as investors.

Levine Leichtman Capital Partners has underlined its commitment to European expansion by hauling in €463m for its second fund dedicated to the region.

Long Ridge Equity Partners has struck the $400m hard cap for its third flagship fundraise, closing the vehicle on almost double the total raised for its sophomore fund.

European private equity house Triton Partners has soared past its target for its second debt opportunities fund to reach a €744m final close.

Canada's FirePower Capital has taken aim at Wall Street and Bay Area private equity and venture capital firms amid the close of its first LP-backed pool of PE capital.

Recent Comments