Africa-focused PE major Helios hires ex-Carlyle EMEA sustainability head as ESG director

African private equity major Helios Investment Partners has brought in former Carlyle EMEA head of sustainability Phil Davis as director of ESG.

African private equity major Helios Investment Partners has brought in former Carlyle EMEA head of sustainability Phil Davis as director of ESG.

American Capital spin-out Northlane Capital Partners has pulled past the $250m mark for its inaugural independent fundraise.

Newly-formed energy-focused private equity and credit investor Andros Capital Partners has hit a $250m hard cap close for its debut fundraise.

Although women-led businesses are more likely to yield market-beating returns, they are woefully neglected by venture capital firms, which are dominated by men

Chicago private equity player CIVC Partners has picked up managed services and technology consulting provider iVision.

Patient Square Capital has been launched in Menlo Park, California by Jim Momtazee and Maria Walker. Patient Square will invest across the health care industry with a specific interest in technology-enabled services, biopharmaceuticals, pharmaceuticals, medical

Lightspeed India Partners has reportedly bagged $275m from LPs in a new venture fund aimed at supporting early-stage startups in the world's second-largest internet market.

Phil Davis is expected to help the Africa-focused firm expand its sustainability and responsible business practices

Syntegon Technology, a portfolio company of CVC Capital Partners, has sold its Viersen-based operations to Rotzinger, a Switzerland-based company that produces conveyor and storage systems used in the packaging industry.

Spanish venture capital house Bullnet Capital has sold version control software (VCS) specialist Codice SW to Unity Technologies, a private-equity-backed US software company.

Growth equity specialist McCarthy Capital has easily beaten the target for its seventh flagship fundraise through a $525m final close.

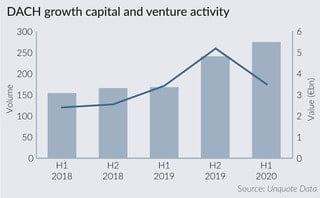

Growth and venture capital deal volume exceeded that of all previous half-yearly figures in the DACH region in H1 2020, making for a busy first half of the year that saw 275 such deals, according

Nordic Capital has shrugged off the potential dangers of launching a flagship fundraise amid the coronavirus pandemic by beating its €5bn target through a first close, it has been reported.

Venture capital performance remained 'unscathed' in the first quarter of 2020 despite the onset of the coronavirus pandemic, as the industry consolidated what had been an exceptional 2019, new research shows.

Initialized Capital, the investment firm launched by Reddit co-founder Alexis Ohanian and ex-Y Combinator partner Garry Tan, has hauled in $230m for its fifth seed fund.

Recent Comments