Tesi et al. in $40m series-B round for Swappie

Online retailer of refurbished smartphones Swappie has raised $40m in a series-B round from existing investors Tesi, Lifeline Ventures, Reaktor Ventures and Inventure.

Online retailer of refurbished smartphones Swappie has raised $40m in a series-B round from existing investors Tesi, Lifeline Ventures, Reaktor Ventures and Inventure.

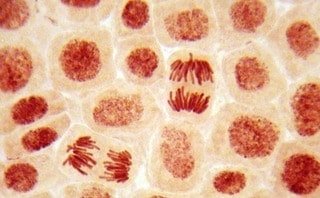

Foresite Capital, Blueyard Capital and Arch Venture Partners have participated in a $41.5m series-A for cell coding company Bit Bio.

Genstar Capital has exited its remaining stake in specialty property insurer Palomar Holdings, after helping it reach a $2bn in market capitalisation.

Limited partners are becoming more satisfied with the transparency in general partners (GPs), repairing from the frustration caused after the global financial crisis, a report from Coller Capital claims.

Founders get new life for their products, while venture firms get exits for slower growth start-ups

The challenge for the European Union will be to implement its COVID-19 crisis measures in such a way that they come to be seen as useful economic tools when more normal times return

Nikola Stojanow, æternity Blockchain co-founder and creator of AE Ventures investment company has begun his next journey with the creation of a new venture capital fund aimed at blockchain.

Sustainable food chain-focused private equity firm Paine Schwartz Partners (PSP) has invested $150m into AgroFresh Solutions.

Silicon Valley Bank looks to be back in the fundraising market with a new $1bn fund, which has already secured over $600m.

The investment in UK-based Social and Sustainable Capital (SASC) is in response to a pandemic-driven rise in demand

The fund launched in 2018 and has surpassed its original €200m target

Recent Comments