Rescale Closes $105 Million in Expanded Series C Funding

KKR, a leading global investment firm, and Apache Capital, a leading investment manager focused on UK residential real estate, announced that KKR and Apache Capital have established a joint venture to create a UK build-to-rent

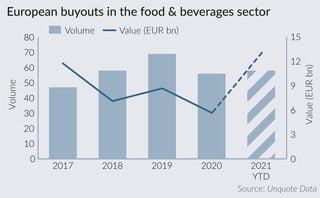

Following CVC Capital Partners' EUR 4.5bn acquisition of Unilever tea unit Ekaterra, the value of announced food and beverage buyouts is set to top a five-year record, at EUR 13bn, according to Unquote Data.

ESG investing is no new concept, but it has certainly exploded in importance over the past few years. The market grew to $715bn last year according to the Global Impact Investing Network, while market participants have also expanded in terms of numbers, knowledge and ideas.

Global buyout giant KKR has launched a €10.8bn buyout for Italy's largest phone company Telecom Italia, Reuters reported. Together with the net debt of €22.5bn, the deal would value the company at an enterprise value

Munich-headquartered UVC Partners has announced the final close for UVC Partners III on EUR 210m, with its additional founder-backed Opportunity Fund bringing its total deployment capacity to EUR 255m.

The $54.9bn-managing Illinois Municipal Retirement Fund has picked a pair of real estate private equity funds for up to $150m of new commitments. The post US pension major IMRF reveals $150m of new private equity

The president’s son was part owner of a venture involved in the $3.8 billion purchase by a Chinese conglomerate of one of the world’s largest cobalt deposits. The metal is a key ingredient in batteries

Commercial space business Sierra Space has scored a stratospheric $1.4bn Series A round, the second-largest private capital raise ever in the aerospace and defense sector. The post Sierra Space scores astronomical $1.4bn Series A growth

CVC Capital Partners is to acquire Ekaterra, the tea business of consumer brands conglomerate Unilever, in a deal that values the company at EUR 4.5bn.

CVC Capital Partners is to acquire Ekaterra, the tea business of consumer brands conglomerate Unilever, in a deal that values the company at EUR 4.5bn.

Recent Comments