ABN Amro sets up €425m impact fund

The fund will invest in early- and growth-stage businesses focused on energy transition, social impact and renewables

The fund will invest in early- and growth-stage businesses focused on energy transition, social impact and renewables

Emeram Capital Partners has sold clinical software platform Meona to impact investor Trill Impact.

Dutch bank ABN Amro has announced the launch of its €425m Sustainable Impact Fund (SIF), a vehicle that will make both private equity and venture capital investments with a focus on sustainability.

B. G., Opalesque Geneva: Matt Breidert, senior portfolio manager and managing director of Listed Sustainable Infrastructure & Energy Transition at TortoiseEcofin, talks to Opalesque about the influence of the new U.S...Article Link

B. G., Opalesque Geneva: Matt Breidert, senior portfolio manager and managing director of Listed Sustainable Infrastructure & Energy Transition at TortoiseEcofin, talks to Opalesque about the influence of the new U.S...Article Link

Unifrax, a portfolio company of Clearlake Capital, has agreed to acquire publicly traded Lydall at an enterprise value of approximately $1.3 billion. Clearlake acquired Unifrax from American Securities in October 2018. Lydall (NYSE: LDL) designs

Middle-market investor GI Partners has held an oversubscribed and above target closing of GI Partners Fund VI LP with $3.9 billion in total commitments. The firm’s earlier fund closed at its hard cap in November

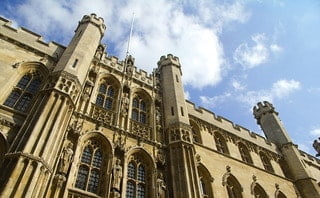

Twelve UK universities have joined forces to create an impact investment fund, Impact 12, to support mission-led university ventures.

Data and transparency will be central if private equity is to meet investors’ concerns about sustainability

Enhanced PE-focused SaaS platform available now for sponsors eager to pursue new deals, achieve operational excellence, accelerate value creation and demonstrate impact(PRWeb June 15, 2021)Read the full story at https://www.prweb.com/releases/maestro_the_private_equity_industrys_collaboration_and_insights_platform_unveils_new_and_expanded_features_amid_todays_frenzied_deal_making_environment/prweb18003297.htm

Posted by Matthew Salerno, Mark McDonald, and Jim Langston, Cleary Gottlieb Steen & Hamilton LLP, on Thursday, May 27, 2021 Editor's Note: Matthew Salerno, Mark McDonald, and James Langston are partners at Cleary Gottlieb Steen

Brexit, substance and transparency requirements, which have resulted in increased regulatory and reporting burden, and also increased cost and uncertainty, have put different jurisdictions to test in different ways over the past years. At the

Bank of China has notched yet another first in Asia’s debt market. The firm’s Hong Kong arm has raised Rmb1.5bn ($232m) from an offshore dim sum bond tagged as a ‘sustainable and smart living’ green

Posted by Jennifer F. Fitchen and Brent M. Steele, Sidley Austin LLP, on Tuesday, March 30, 2021 Editor's Note: Jennifer F. Fitchen and Brent M. Steele are partners at Sidley Austin LLP. Related research from

Opalesque Industry Update - Hedge funds started 2021 strongly outperforming the global equity market amidst the turbulence in retail trading resulting in a risk-off environment, said Eurekahedge. Hedge fund managers returned 1.00% in January 2021,

Goldman Sachs Asset Management (GSAM) has made a non-voting minority equity investment in Arlington Capital Partners. Arlington Capital was founded in 1999 and has completed over 90 acquisitions since its inception. Sectors of interest include

The German provider of laboratory services to the food, environment and pharmaceutical sectors, also serves the growing European medical cannabis industry

Redwire, a portfolio company of AE Industrial Partners, has acquired Deployable Space Systems. Deployable Space Systems (DSS) is a provider of mechanisms, deployable structures, telescopic booms, and solar arrays used in satellite and space applications.

Laxman Pai, Opalesque Asia: Environmental, social, and governance (ESG) investments saw a strong performance and an influx of flows in 2020 and are expected to be a key driver of organic asset growth for money

As the energy-focused impact investor develops its European division, EIP managing partner Matthias Dill discusses the firm's origination network, its sector focus, and impact investing in a more competitive era. By Katharine Hidalgo

Recent Comments