Blackstone credit arm GSO said to eye $7.5bn for new mezzanine fundraise

Blackstone's credit platform GSO Capital Partners is reportedly out raising up to $7.5bn for its latest mezzanine debt fundraise.

Blackstone's credit platform GSO Capital Partners is reportedly out raising up to $7.5bn for its latest mezzanine debt fundraise.

Golding Capital Partners has picked up €200m for the first close of a new debt fund as it looks to back struggling companies battered by the coronavirus pandemic.

Pan-African private equity house Helios Investment Partners has picked up a $100m commitment for its fourth pan-African fund as it eyes a reported $1.25bn for the vehicle.

New York buyout house Lindsay Goldberg has passed the $3.3bn mark for its fifth flagship fundraise, putting it close to its $4bn goal.

Singapore-based asset manager Indies Capital Partners has hit a $100m first close for its third private equity and structured credit fundraise.

Stafford Capital Partners has hit a $532m interim close for its ninth fund targeting secondaries stakes in timberland funds.

EQT has set a mammoth €12.5bn goal for its latest flagship infrastructure fundraise - just a year after it closed its €9bn predecessor fund.

CDC Group and Finnfund have anchored the $202m first close of Africinvest's latest pan-Africa private equity fundraise.

Southfield Capital is back in the market for its third flagship fundraise three years after closing its sophomore fund, and confirming its recovery from its torrid time in the wake of the 2008 global financial

645 Ventures is eyeing a hefty fund size hike after launching a new fundraise targeting up to $100m.

LBC Credit Partners has passed the halfway point for its $1bn-targeting fifth flagship fundraise.

Rothschild & Co-backed private equity investor Auster Capital has passed the $500m mark in a first close of its debut fundraise.

A pair of former EQT execs are more than halfway to their SEK1bn ($106m) target for their second private equity fundraise through their firm MVI Advisors.

Asset manager Unigestion has picked up more than €600m of new capital across interim closes for a pair of private equity fundraises.

Chicago-based buyout house Periscope Equity is back in the market with its sophomore fundraise, eyeing up to $200m.

Life sciences-focused private equity house Aisling Capital has raised more than $144m towards its latest flagship fundraise.

Central Europe-focused private equity house Genesis Capital has launched a €150m fundraise for its sixth flagship buyout vehicle.

KKR has hauled in more than $10bn for its fourth pan-Asian private equity fund, putting it within a whisker of becoming the biggest-ever PE vehicle raised targeting the region.

LA-based early-stage investment house Upfront Ventures is back in the fundraising market with its seventh flagship fund.

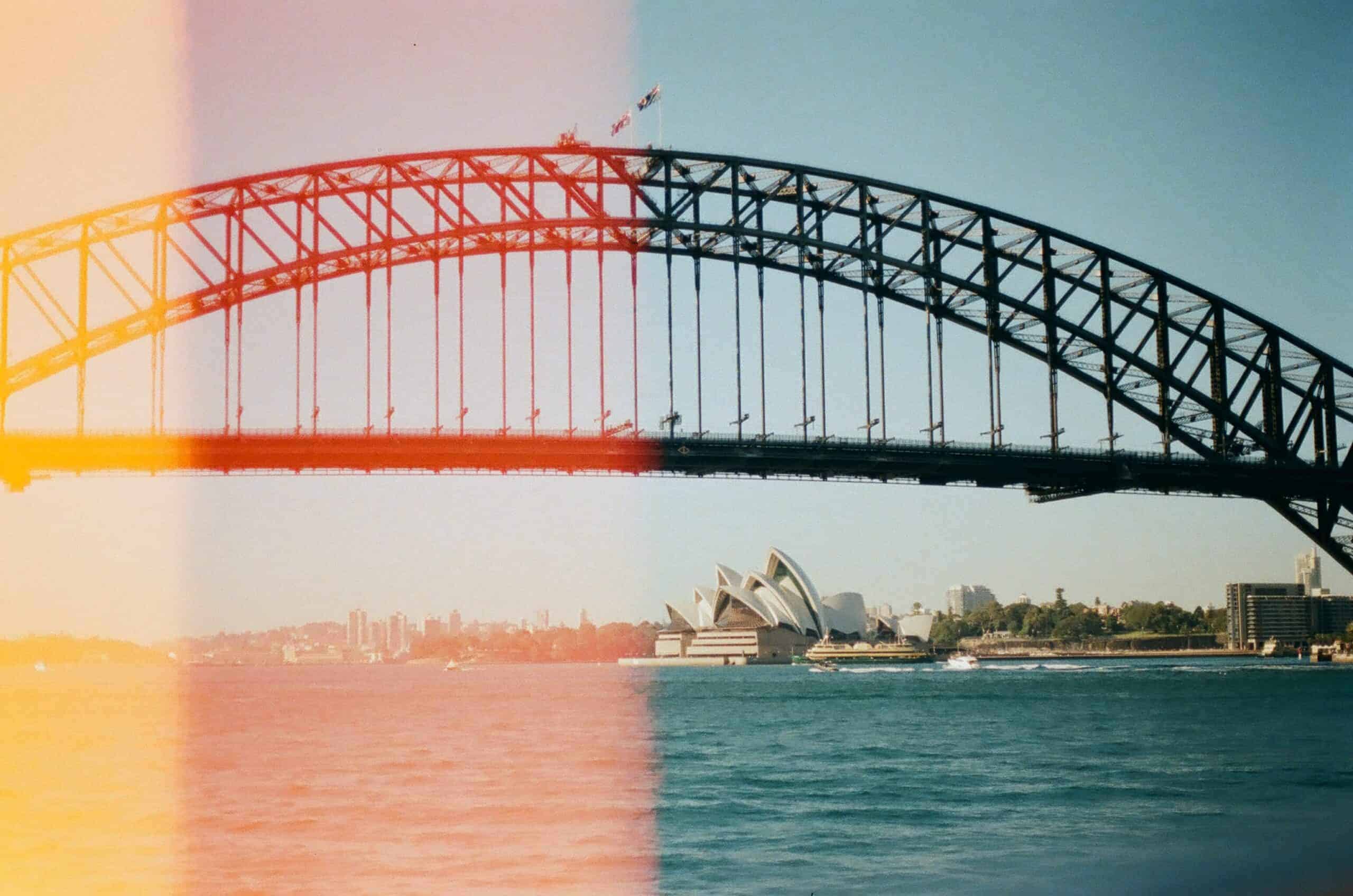

Riverside has raised more than $260m towards its latest Asia-Pacific fund, which the firm has rebranded to underline its heavy focus on the Australasian market.

Recent Comments