Connie Health Secures an Additional $13 Million to Scale Its Tech-enabled Medicare Navigation Platform

Venture capital and private equity bias—fueled in part by an aversion to small companies not aspiring to be billion-dollar venues—has choked the flow of cash to thousands of underrepresented...(PRWeb July 28, 2021)Read the full story

Laxman Pai, Opalesque Asia: British hedge fund manager Man Group posted a record record-high funds under management (FUM) during the first six months of 2021, predominately driven by a "strong investment performance...Article Link

The publicly-traded Swedish firm recently announced or closed three deals in the sectors that total about $12bn

Bregal Unternehmerkapital has acquired Germany-based thermoelectric technology business Laird Thermal Systems (LTS) from Laird, a portfolio company of Advent International.

Private equity major Thoma Bravo has agreed to take customer feedback software maker Medallia private in an all-cash transaction that values the company at $6.4bn. The firm said the deal would provide the company with

Intermediate Capital Group (ICG) has closed an initial EUR 1.45bn ESG-linked subscription facility for its eighth European direct lending fund, ICG Europe Fund VIII.

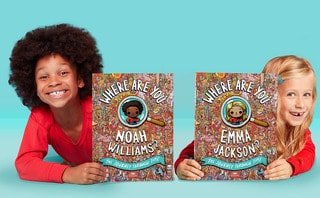

Graphite Capital has acquired UK-headquartered personalised children's books publishing platform Wonderbly.

Private equity house Permira is gearing up for the launch of its new buyout fund.

Europe was home to a record EUR 38bn's worth of venture and growth capital investment in the first half of 2021, shattering previous records, according to Unquote Data.

Eurazeo has held a final close for Idinvest Private Debt V on EUR 1.5bn, exceeding its EUR 1.2bn target.

Recent Comments