Tiny Organics Announces $11 Million In Series A Round To Accelerate Its Mission To Shape The Palates Of A Generation

B. G., Opalesque Geneva: Matt Breidert, senior portfolio manager and managing director of Listed Sustainable Infrastructure & Energy Transition at TortoiseEcofin, talks to Opalesque about the influence of the new U.S...Article Link

B. G., Opalesque Geneva: Matt Breidert, senior portfolio manager and managing director of Listed Sustainable Infrastructure & Energy Transition at TortoiseEcofin, talks to Opalesque about the influence of the new U.S...Article Link

Unifrax, a portfolio company of Clearlake Capital, has agreed to acquire publicly traded Lydall at an enterprise value of approximately $1.3 billion. Clearlake acquired Unifrax from American Securities in October 2018. Lydall (NYSE: LDL) designs

Platinum Equity has agreed to acquire a majority stake in SVP-Singer Holdings (“SVP Worldwide”), the world’s largest consumer sewing machine company. Singer was formed in 1851 by Isaac Singer and Edward Clark. The company began

Middle-market investor GI Partners has held an oversubscribed and above target closing of GI Partners Fund VI LP with $3.9 billion in total commitments. The firm’s earlier fund closed at its hard cap in November

Palladium Equity has added Meahgan O’Grady to its team as Director of Business Development, a newly-created position. Through her past work experience, Ms. O’Grady brings to Palladium numerous relationships across multiple channels, including development teams

Lender controlled by private equity firm Cerberus will buy HSBC’s French retail operations for a symbolic one euro

Dutch PE firm Waterland is to acquire Norwegian company Bano, a provider of bathroom products for the healthcare sector.

Munich-based asset management firm Golding Capital Partners has held a first close for its co-investment fund on €161m.

Oakley Capital has agreed to acquire Pimavera Business Software Solutions, a Portuguese business management software company.

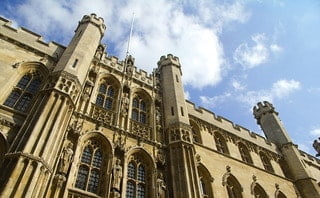

One Equity Partners (OEP) has acquired UK-based electrical power generator and motor producer Brush Group.

IK Investment Partners has entered exclusive discussions with UK-based PE firm Fremman Capital to exit fuel testing company Veritas Petroleum Services (VPS).

Bridgepoint has acquired a minority stake in UK-based East Asian food chain Itsu, continuing its partnership with founder Julian Metcalfe.

August Equity Partners has invested in Ireland-based cyber security company Integrity360.

Twelve UK universities have joined forces to create an impact investment fund, Impact 12, to support mission-led university ventures.

Providence, I Squared Capital and CVC Partners are among a select pool of suitors admitted to the second round of bidding for Marlink, according to four sources familiar with the matter.

Recent Comments