Google, Andreessen Horowitz back cloud-native networking company Isovalent

Isovalent, a cloud-native networking company, has launched its services to help enterprises connect, observe and secure modern applications with its Cilium product.

Isovalent, a cloud-native networking company, has launched its services to help enterprises connect, observe and secure modern applications with its Cilium product.

ARA Asset Management and property company Chelsfield have raised a S$385.8m ($286m) green loan to finance the acquisition and renovation of 5One Central, a commercial building in Singapore.

SINGAPORE--(BUSINESS WIRE)-- Global investment firm KKR today announced the appointment of Jim Rowan, former Chief Executive Officer of Dyson Ltd., as a Senior Advisor to KKR’s Asia Private Equity team. Mr. Rowan brings more than

Posted by Sarath Sanga (Northwestern University) and Eric L. Talley (Columbia University), on Tuesday, November 10, 2020 Editor's Note: Sarath Sanga is Associate Professor at Northwestern University Pritzker School of Law, and at Kellogg School

Companies would have to report on the financial impacts of climate change on their businesses within the next five years

CEE-based private equity firm Innova Capital will acquire an undisclosed stake in Polish cosmetics brand Bielenda Kosmetyki alongside its management.

Bridgepoint has acquired a minority stake in Swedish skin clinic operator Diagnostiskt Centrum Hud (DCH) alongside its management.

Technology-focused corporate finance firm Clipperton has hired Nikolas Westphal as a partner in its Berlin-based team.

Video gaming-focused venture capital house Griffin Gaming Partners has raised $235m to invest across the already titanic industry.

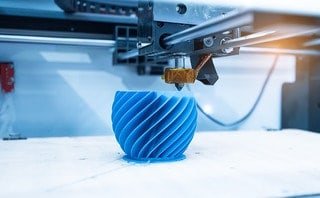

High-Tech Gründerfonds (HTGF), Bayern Kapital and Deutsche Balaton have led a €2m round for All3DP, a 3D printing internet platform.

Lea Partners has sold financial performance management software IDL to US-based Insightsoftware, a portfolio company of TA Associates and Genstar Capital.

Distressed investment specialist Cerberus Capital Management is reportedly eyeing up to $3bn for its latest flagship fundraise.

Credit and distressed specialist Värde Partners has held a final close for its Värde Dislocation Fund on $1.6bn, exceeding its $1bn target after five months on the road.

European lottery operator Sazka Group has picked up a €500m investment from private equity giant Apollo Global to value the business at about €4.2bn.

SoftBank Vision Fund has led a $250m funding round for Germany-based e-scooter startup Tier Mobility.

TA Associates has brought in Advent International fundraising exec Andrew Harris as its new global investor relations head.

EQT has agreed to sell Danish portfolio company Tia Technoloy to the listed software company Sapiens.

Recent Comments